Updated: March 7, 2022

The main photo is courtesy of Connect Homes which showcases their Connect 2 640 square feet ADU model.

With an increase in permits for ADUs (Accessory Dwelling Units) across the United States, homeowners need to insure that they will reap an ample return on their investment in a reasonable period of time. Knowing the projected value of your ADU is extremely important, as different regions of the US have different construction and labor costs, as well as differing attitudes towards speculative properties.

HomeLight, a leading real estate technology platform and referral marketplace, recently released its Top Agent Insights for End of Year 2021, which contained feedback from real estate agents from across the country that we found to be quite surprising. We especially took note of the findings regarding ADUs, as they continue to be of heightened interest to both homeowners and renters alike.

Taking the perspective of the homeowner, we summarize key ADU-related findings from the nearly 100-page report, which includes the following metrics, segmented by region within the US:

- Average Value for an ADU: $65,908

- Average Cost to Build an ADU: $77,239

- Average Return on Investment for an ADU: 38% (using Pre-Covid timing)

Table of Contents

- Regional Differences in ADUs

- The Changing Use of ADUs: Multigenerational Living

- The Most Common Types of ADU by Region

- What are the Costs of an ADU?

- How Much Value Does an ADU Add to a Property?

- Average Percent Increase in Resale Value for an ADU Property

- Average ROI of an ADU Based on Agent Cost and Value Estimates

- Closing Thoughts on Valuing ADUs

- ADU & Real Estate Resources

Also see these related articles:

Regional Differences in ADUs

California, and Los Angeles in particular, still lead the nation in ADU permits and building construction year over year. This is expected, as the need for more living space can be felt in larger metro areas – be it an attic apartment, garage conversion, basement conversion, or a newly built ADU, attached or detached. As we noted previously in an overview of Prefab ADUs, the state of California has implemented policies favorable to the proliferation of ADUs, as a method to increase the state-wide housing supply.

Though the rest of the country is following California’s lead by also investing in ADUs, the reasons for this investment, however, are not the same as California. The regional differences regarding ADU Type, Reason for ADU Construction, Cost-to-Build and Average Value-Added are astounding.

Real Estate Regions for Top Agents Insights Report 2021

Image courtesy of HomeLight.

The Changing Use of ADUs: Multigenerational Living

Historically ADUs have largely been used to house elderly parents and other relatives, hence the alternative names Granny Flat, In-law Apartment, and Mother-in-Law Suite. In many regions of the US, granny flats are making a comeback as multi-generational living arrangements return to American families.

With concerns rising over nursing home conditions, as well as inconsistent visitation and travel restrictions, families are finding it less stressful – mentally, emotionally and financially – to take care of their parents nearby in an ADU.

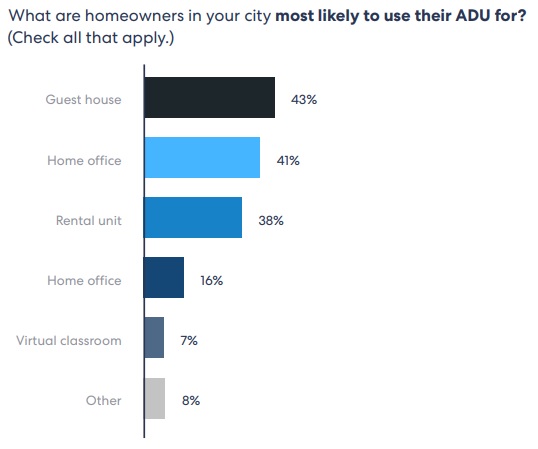

According to the HomeLight report:

The top two uses of an ADU nationwide are 1) to house parents of the owner living there (61% cite this as a common use in their market) or 2) to support adult children who need temporary housing for financial reasons (35%).

Interestingly, across all regions of the US, housing aged parents is the most common use for ADUs, with this being particularly true in the South Central region in states such as Texas, Oklahoma, Tennessee and Arkansas. According to South Central agents who responded to HomeLight’s survey, 67% report that local homeowners often have parents residing in their ADU.

Rental of an ADU for the purpose of supplementing income is actually the third most common use as per the report.

Image courtesy of HomeLight.

The Most Common Types of ADU by Region

ADUs can be constructed in many forms: Detached, Attached, Interior Conversion, or Garage Conversion. Is it part of the existing living space, as an attached interior or garage conversion? Or is it a separate unit detached from the main property?

It is no surprise that the most common ADU type is a detached unit that sits somewhere on the property, with no shared walls with the home’s main structure. Four out of the six regions favor separate detached units. However, the Midwest and Northeast sectors favor Interior Conversions to separate detached units, 27% and 38% respectively. We suspect that colder winter climates may be a key variable for this preference.

Regions that Prefer Detached ADUs

- Pacific: 58%

- South Central: 43%

- Mountain: 40%

- South Atlantic: 23%

Regions that Prefer Interior ADU Conversions

- Midwest: 27%

- Northeast: 38%

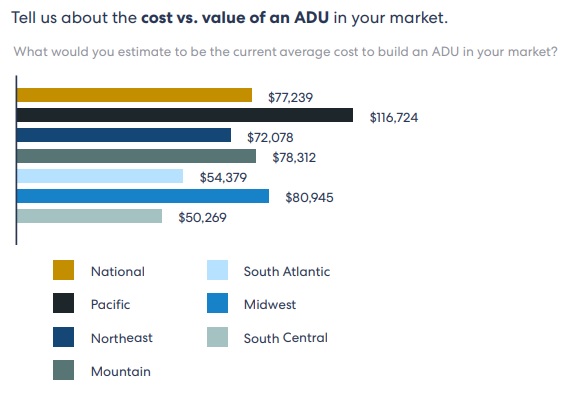

What are the Costs of an ADU?

The average national cost to build an ADU is $77,239. However, costs to build an ADU vary dramatically depending upon in which region of the US you plan to build your structure.

It should be no surprise that respondents in the Pacific region gave the highest cost for ADU construction, with an average cost of $116,724. The Mid-West region was slightly higher than expected with an average cost of $80,945. Not surprising was the South Atlantic region’s average cost of $54,379, making it 46.6 % of Pacific region’s average cost.

Image courtesy of HomeLight.

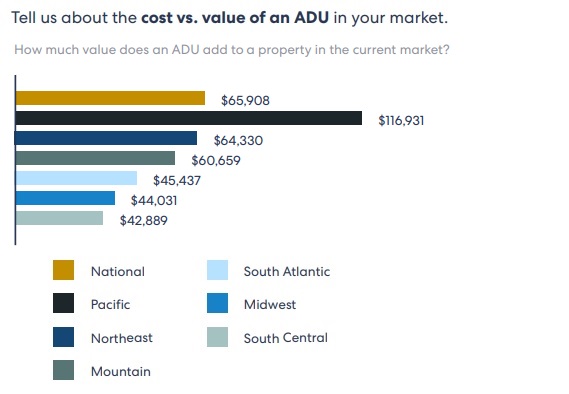

How Much Value Does an ADU Add to a Property?

A significant Return-on-Value is what homeowners hope for when they decide to construct an ADU to their existing property. All things not being equal, it should be no surprise that nationally ADUs add the most value in the Pacific region adding on an average $116,931 to the existing property’s worth.

However, the cost to construct the unit is highest in the Pacific region, meaning that the average return is negligible. The Midwest has the best return on ADU value, showing a 54% average boost in value to the property compared to 38% nationally.

Image courtesy of HomeLight.

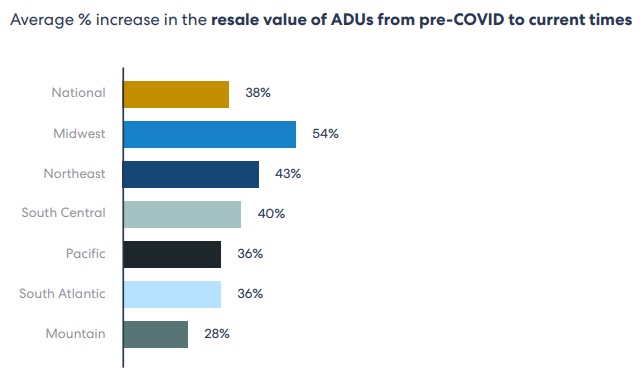

Average Percent Increase in Resale Value for an ADU Property

Consistent with the peculiar times in which we are living, the real estate market appears to have a mind all its own. Property values continue to rise in many regions throughout the US, even as the cost of living rises and unemployment figures remain above 5% for the nation.

The Midwest leads the average percent of increase in resale value for homes with an ADU with a 54% average increase in value. The Pacific region, although not leading, will return 36% on average for an ADU construction. The Northeast and South Central US return 43% and 40% respectively.

Image courtesy of HomeLight.

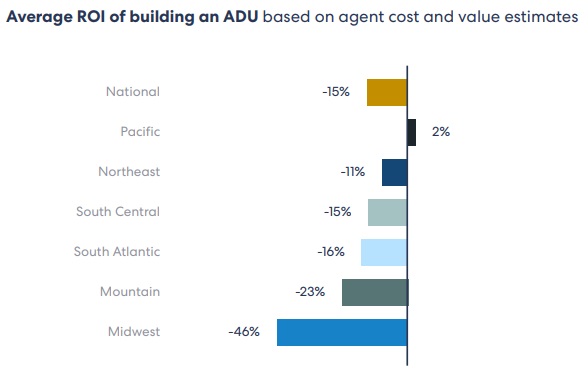

Average ROI of an ADU Based on Agent Cost and Value Estimates

According to this survey, unfortunately, the average ROI or resale value of an ADU is not encouraging, based on agent estimated costs and value estimates. Nationally, the average ROI is -15%, since the cost to build and the added value are disproportionate to each other.

With the exception of the Pacific region, all other regions have negative ROI or return on investment for an ADU project. Only in the Pacific region can you expect a negligible return or breakeven at 2% ROI.

Image courtesy of HomeLight.

Closing Thoughts on Valuing ADUs

Though these findings may appear to be bleak in the short-term, our long-term perspective on ADUs remain highly optimistic, for reasons explained previously:

- Why Homeowners Should Invest in a Prefab ADU

- Choosing Between a Prefab ADU and a Stick-Built ADU

- Financing an ADU with a Noah Shared Equity Contract

- The Impact of ADUs on Your Neighborhood: Perceptions vs. Reality

General Rules to Follow When Valuing an ADU

In terms of how to project the value of an ADU investment accurately, here are a few general “rules” to keep in mind to simplify the process and increase your chances of a positive ROI:

- Detached ADUs are more valuable than Attached ADUs which are more valuable than ADU Conversions

- Your cost-per-square-foot to build an ADU should be significantly lower than the current price-per-square-foot to purchase a comparable home in your neighborhood. In other words, the cost of newly added living space should be safely lower than current assessment rates.

- ADUs are risky investments if the primary purpose is to facilitate a short-term, positive-ROI sale. ADUs should be considered long-term investments that can provide a host of benefits that are not just financial for many years to come.

ADU & Real Estate Resources

- HomeLight

- HomeLight Top Agent Insights End-of-Year 2021 Report Overview

- HomeLight Top Agent Insights End-of-Year 2021 Report (PDF)

- HomeLight Top Agent Insights End-of-Year 2021 ADU Infographic

- Mother-in-Law Suites on the Rise: How Much Value Do They Add?

- ADU Guides from Housable

- Housable: The ADU Marketplace for California

- Dwellito: The Modular Home Marketplace

- Directory of Prefab Modular Companies by State

- LandWatch: Find land for your future home or ADU

Recommended Reading from Purgula

- Never Thought You’d Live in a Multigenerational Home? Think Again!

- Want a Nontraditional House? Here’s How to Finance It!

- Why Homeowners Should Invest in a Prefab ADU

- Choosing Between a Prefab ADU & a Stick-Built ADU

- Top Prefabricated ADU Companies

- The Impact of ADUs on Your Neighborhood: Perceptions vs. Reality

- 10 Ways to Monetize Your Home

- How Landlords Can Find The Perfect Tenant

- Never Thought You’d Own Land? Think Again!

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |