Finding the Right Homeowners Insurance Policy is not Easy

Homeowners with properties difficult to insure know the torment of procuring adequate coverage in today’s homeowners insurance market. Residents in flood zones or high-risk fire areas fill discussion boards with pleas for help after being notified that their insurer has dropped them, based on an actuary’s updated perceived risks.

Homeowners are then forced to search the Internet expediently for accurate and legitimate insurance quotes from an overwhelming number of options. Ads promising “Quick Home Insurance Quotes” and “Compare and Save Money” are ubiquitous on the Internet, while instilling anxiety that these sites may be aggressive spammers.

Though on the surface, these websites appear to be authoritative “insurance” sites, their primary purpose is to serve as referral marketing engines for insurance carriers. They are compensated for delivering in-market prospects to carriers.

These types of advertisers typically represent sites that sell your submitted contact information to insurance providers, often determined by the profitability of the lead, as opposed to the best match for the needs of the customer. In turn, the paying insurance companies reach out to you in an attempt to win your business.

These websites are likely neither licensed insurance brokers nor agencies. By not being licensed to sell insurance, these companies can only deliver quotes that are estimates. This means additional information will need to be provided to a representative of the actual insurance carrier to receive an accurate and legal quote.

Insurance aggregation sites that are licensed brokers or agencies, most likely only represent insurance carriers that belong to the same umbrella parent corporation. Thus, consumers will only get a limited choice of options from the market.

The “theory” of this marketing referral practice is not inherently bad, but the “practice” of it has been less than perfect at best, to utterly annoying at worst. Young Alfred was formed to improve this experience with the primary focus on better serving the needs of homeowners.

Young Alfred’s Mission

Young Alfred seeks to surpass the typical experience of using aggregator quote sites, as it offers an advanced home insurance shopping platform that enables customers to purchase policies (home, auto, renters, pet) that are specific to their needs. Customers have found Young Alfred to be exceptionally helpful, when it comes to insuring them in “hot spots” for which other insurance carriers have refused to provide coverage.

Founded in 2016 by two Wharton Business School graduates, and based in Philadelphia, the company is a venture-backed enterprise with funds from Gradient Ventures, Google’s artificial intelligence focused venture capital fund, amongst other highly selective investors. Co-CEOs Jason Christiansen and David Stasie, were graduate school classmates with private equity and hedge fund experience, who discovered that home insurance expertise was lacking in the marketplace.

Their research revealed that there was a void of data for consumers to make smart purchases of homeowner insurance policies. Thus, they created Young Alfred to empower homeowners with data and technology to better equip them to compare and purchase coverages online.

The founders embodied their mission into a superhero butler, named Alfred, whose mission is to make insurance shopping safe and easy, conveyed in this video:

Here are four important reasons why we recommend using Young Alfred to purchase a homeowners insurance policy.

1. Young Alfred Is A Licensed Insurance Agent

Unlike lead generators, Young Alfred is a licensed insurance agency in all 50 states, plus DC, that has direct relationships with over 40 insurance carriers. This means Young Alfred is permitted to sell insurance policies directly, which makes it a true insurance marketplace. As an independent agency, they are not allowed to charge customers a fee for their service. They are compensated instead by their insurance partners by receiving commissions on sold policies.

Conversely, lead generation sites inherently add an extra step in the process, as they must handoff one’s contact info to a third-party licensed agent or carrier. Poorly managed handoffs often lead to low customer satisfaction and high levels of distrust.

It is important to clarify that Young Alfred is NOT a Managing General Agent (MGA), which means, among other things, that they do not handle insurance claims on behalf of homeowners. An MGA underwrites policies, sets prices, and processes claims, which is why they need reinsurance. Lemonade and Hippo are two well-known MGAs, whose policies are both available for purchase through Young Alfred’s site.

Though Young Alfred does not provide these services, they do provide expert advice on claims, always recommending that you get in touch with them prior to filing a claim. The premiums that Young Alfred offers are exactly what you would receive from the carrier, if you were to apply directly with the insurer. Therefore, there is no cost-savings by going direct, in case you were wondering.

By going through an independent agent like Young Alfred, you get the same pricing, PLUS someone in your corner to make sure you are getting the right coverage and assistance with your claims. Young Alfred has expertise in home insurance across a wide range of geographies and dwelling types. Homeowners are allowed to comparison shop, based on their specific needs and unique profile e.g. type of construction of your home, plumbing, roof age, etc.

Further proof of Young Alfred’s insurance expertise can be found on their comprehensive insurance blog that is replete with short, easy-to-understand articles. Topics covered include everything from Flood Policy Waiting Periods to the difference between HO6 (Condo) and HO4 (Renters) policies.

2. Young Alfred Uses Smart Data to Simplify Your Options

Young Alfred’s service goes beyond the “who” and the “what” of insurance policies, as it delves deeper into the fine print under each policy form. Young Alfred uses your street address to analyze your geography and assess your known risks based on past events.

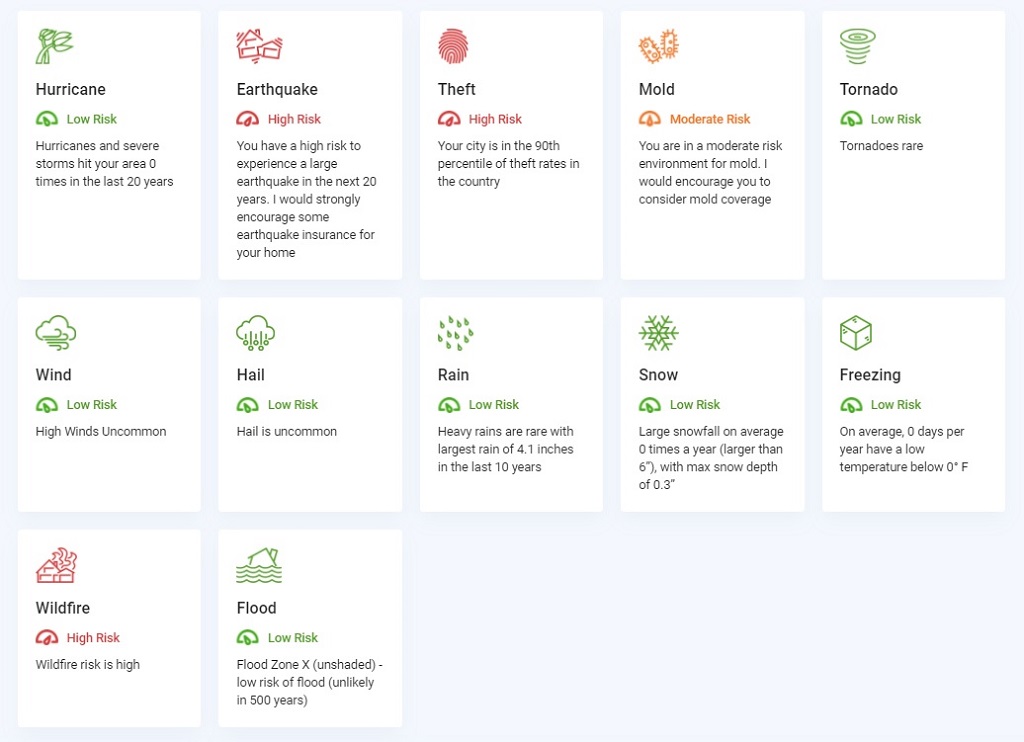

Prior to submitting property details, you can receive a free risk assessment report based on the address of your property. This is a good example of simplifying the purchasing process by highlighting the key threats for which you should hold adequate coverage. The risk assessment categories consist of: hurricane, earthquake, theft, mold, tornado, wind, hail, rain, snow, freezing, wildfire, and flood.

The engine behind Young Alfred’s competitive advantage lies in its ability to analyze billions of data points for every customer to find the ideal insurance option for that customer’s particular need. Traditional insurance has typically taken a “one size fits all” approach, which often becomes evident once homeowners file a claim.

As previously mentioned, most insurance quote websites only serve to gather your information to provide a lead to insurance carriers. The downside here is that they may not be providing the customer with the right alternatives or customizing the product to the homeowner’s specific needs and requisite coverage.

Young Alfred’s approach is not only technologically different than that offered by lead generation sites, but they are able to deliver “best-fit” quotes with more accurate pricing. Using over 30 different technical tools, in addition to applying machine learning to identify customer risks and needs, Young Alfred is able to customize products and offer three price points for a better selection of policies.

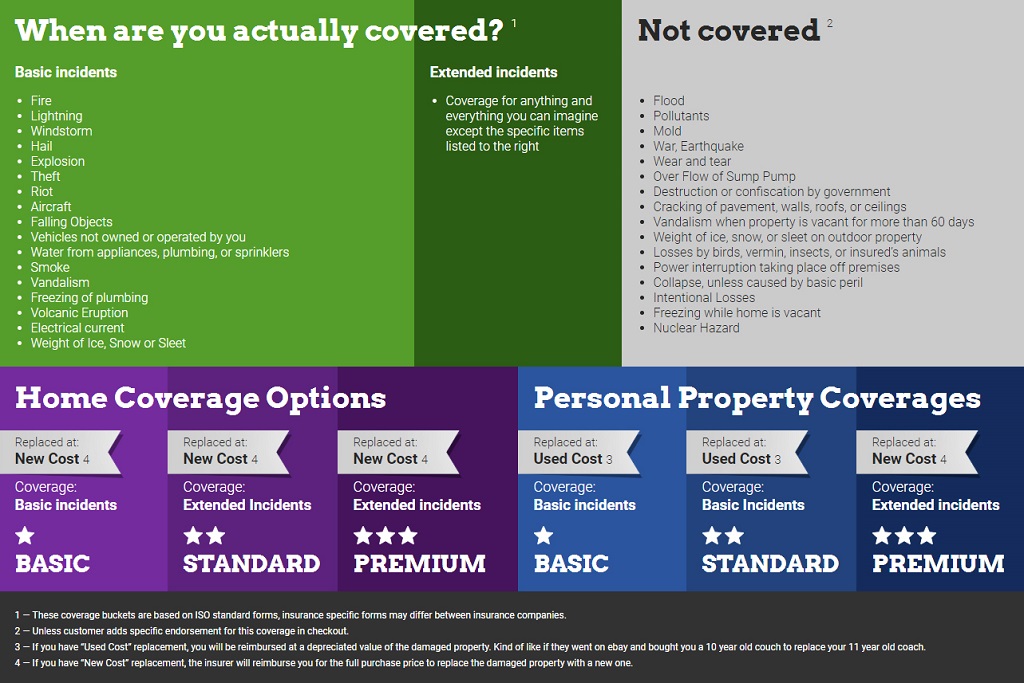

Homeowners are first presented with tiered coverage choices of Basic (HO2), Standard (HO3) or Premium (HO5). Young Alfred also provides a recommendation for one of these tiers, which represents the best-fit coverage based on their data analysis. Once you select one of these tiers, you will then receive comparison details of competing coverages by email, which can be viewed without any obligation.

Basic vs. Standard vs. Premium Coverage

An easy-to-understand overview of how to get a homeowner insurance quote is available on Young Alfred’s website.

3. Young Alfred Does Not Sell Your Information

Because Young Alfred is a licensed insurance agency, their website is an actual insurance marketplace, which means that they can sell insurance policies directly to you. They are solely compensated from commissions on sold policies from their insurance carrier partners, and DO NOT sell personal information, as do insurance referral sites.

With lead generation sites, once you submit your personal information it is sold to third-parties, so that these insurers can then market to you directly by email, text, phone or mail. You may not even be aware of which companies received your contact information.

With Young Alfred, you remain in control of your personal information and do not expose yourself to being contacted by third-parties, without your permission. If you choose not to purchase any of the proposed quotes, you will not be contacted by any third-parties.

When you do purchase a policy through Young Alfred, naturally you will be put in contact with the insurer as a new customer. However, you can still maintain a relationship with Young Alfred, as they will serve as an advocate on your behalf with any questions you may have going forward.

4. Young Alfred Is Especially Helpful For Hard-to-Insure Properties

Because of Young Alfred’s comprehensive and innovative approach (insurance expertise, data & technology, strict personal information policy), their service is especially effective at helping homeowners with difficult to insure properties. Not only can they find an insurer, but most importantly, they can find the best-fit coverage for your situation from many options and data points.

Key to their process is having the homeowner provide as much accurate and detailed information about the property up-front, so that Young Alfred can both highlight details of specific types of coverage best suited for you, while also matching you to insurers that best offer these specific coverages.

Also critical to this process is Young Alfred’s ability to stay current with all of its partners’ add-on coverage packages. Popular add-ons include:

- Earthquake

- Flooding

- Home Daycare

- Home Sharing (e.g. Tenants & Airbnb)

- Identity Theft

- Lateral Lines Coverage (Sewer, Cable, Gas, etc.)

- Mold

- Personal Umbrella (Extra Liability Coverage)

- Replacement Costs (Home)

- Replacement Costs (Personal Property)

- Scheduled Personal Property (Specific Cash-Value Items)

- Sewage Back-Up/Sump Pump

The results are easy-to-understand, apples-to-apples comparisons that enable homeowners to make a highly-informed decisions of tremendous importance. To get more familiar with what is typically covered by plans and details of add-ons, use the coverage widget on Young Alfred’s helpful learning center.

Summary of Young Alfred Benefits

Part of the tedium of purchasing new homeowners insurance is reading and understanding the fine print. Young Alfred takes the worry out of this task by making sure new policy holders understand the policy language – what is and isn’t covered.

Young Alfred does this by combining technology and human expertise to help homeowners easily understand coverage options and make wise purchase decisions best for their situations. Here is a summary list of key benefits to using Young Alfred to find a homeowners insurance policy just right for your needs.

Licensed Independent Insurance Agency

- Accurate and Legal Quotes

- Quotes that can be Purchased Online

- Homeowner Advocacy

- Licensed in 50 States + DC

- Comprehensive, Easy-to-Understand Blog

- Deep Insurance Knowledge

- Licensed Agents Available by Phone

Smart Data & Technology

- Data Analysis to Determine Best-Fit Coverage (from 3 Scenarios)

- Easy Interface to Enter Vital Details of Home

- Up-To-Date Add-On Products from Insurance Partners

- Helpful for Hard-to-Insure Properties

- Simplifies Coverage Selection Process

No Selling of Personal Information

- Personal information is not sold to receive quotes

- No third-parties will contact you without your permission

- You deal solely with Young Alfred until you choose to purchase a policy

- You remain in control of your information

- Young Alfred has High Customer Ratings on TrustPilot

Especially Helpful For Hard-to-Insure Properties

- Sells Policies in 50 States + DC

- Sells Policies of Over 40 Insurance Carriers, National & Regional

- Sells Policies of a Diverse Set of Carriers with Different Products & Risk Criteria

- Provides Easy But Comprehensive Data Input Process to Capture Key Traits of Home

- Matches Key Needs with Up-To-Date Add-On Products

- Simplifies Coverage Selection Process

More Information on Young Alfred

Young Alfred Free Homeowners Insurance Quote

Young Alfred Free Risk Report

Young Alfred Learning Center Coverage Widget

Young Alfred Website

Young Alfred Blog

Young Alfred Frequently Asked Questions (FAQs)

Young Alfred Trustpilot Customer Reviews

Young Alfred Privacy Policy

Related Articles

Hippo Homeowners Insurance: Personalized Convenience Using Insurtech

Home Warranties: Do You Need One? Options & Alternatives

Homeowner Liability With DIY Projects

Protection And Safety For Your Home Renovation Project

Security And Safety Products For Your Home Renovation Project

Have you visited the new Purgula News page? It covers all things related to homeownership, home improvement, interior design, real estate, budgeting, financing, etc. – updated daily!

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |