Updated: December 10, 2022

Opendoor (NASDAQ: OPEN) has been on the radar of the Federal Trade Commission (FTC) and a bevy of Class Action Law firms looking for a lead plaintiff to represent investor claims of violations of the federal securities laws, while experiencing a massive stock devaluation.

Here’s a deeper dive into the recent turmoil the leading iBuyer firm has encountered and what it means to homeowners and investors.

Table of Contents

- Opendoor’s Current Situation

- Opendoor’s iBuying Business Model

- What to Know About AVMs (Automated Valuation Models)

- Opendoor and the Future of iBuying

- What Investors Should Know

- What Homeowners Should Know

- Our Thoughts on the Future of Opendoor & iBuying

Also see:

- Opendoor’s Pending Class Action Lawsuit: What You Need To Know

- Opendoor Timeline of Events

- Homebuyer Beware: The Perils of Flipped Homes

- Why Digital Twins are the Future of Homeownership

- More Recommended Real Estate Reading

- Related Topics: Home Buying | Home Selling | Virtual Staging | Pre-Sale Renovations

Opendoor’s Current Situation

What’s Opendoor?

Opendoor is part of a new breed of residential real estate investors, known as iBuyers, that use digital platforms with complex, mathematical algorithms to time the purchase and sale of real estate properties to make a profit.

The concept is simple, a homeseller approaches Opendoor, who runs details about the home and its corresponding market into an AVM or Automated Valuation Model. Using a proprietary algorithm together with proprietary information of “100 data points on each home”, Opendoor is able to arrive at a statistical “market value” for the property. Opendoor uses this information to then make an offer to the homeseller.

Once the sale agreement is executed and the property trades owners, Opendoor makes light repairs, if necessary, and re-sells the property to a homebuyer, typically holding the property for up to 90 days. In short, Opendoor is essentially a house-flipper.

What the Class Action Complaint Alleges

The Opendoor class action lawsuit alleges that offering documents from the company’s December 21, 2020 Initial Public Offering (IPO) and defendants from the company made false and/or misleading statements and/or failed to disclose that:

- The algorithm used by Opendoor to make offers for homes could not accurately adjust to changing house prices across different market conditions and economic cycles;

- As a result, Opendoor was at an increased risk of sustaining significant and repeated losses due to residential real estate pricing fluctuations;

- And accordingly, defendants overstated the purported benefits and competitive advantages of the algorithm.

Already admonished by the FTC in August 2022, Opendoor, based in Tempe, Arizona, reached an agreement with the Commission on claims of deceptive tactics, by paying a $62 million settlement.

It would come as no surprise if the Securities and Exchange Commission (SEC) were to become interested in the current complaint, as the company’s CEO, Eric Wu, stepped down on December 1, 2022.

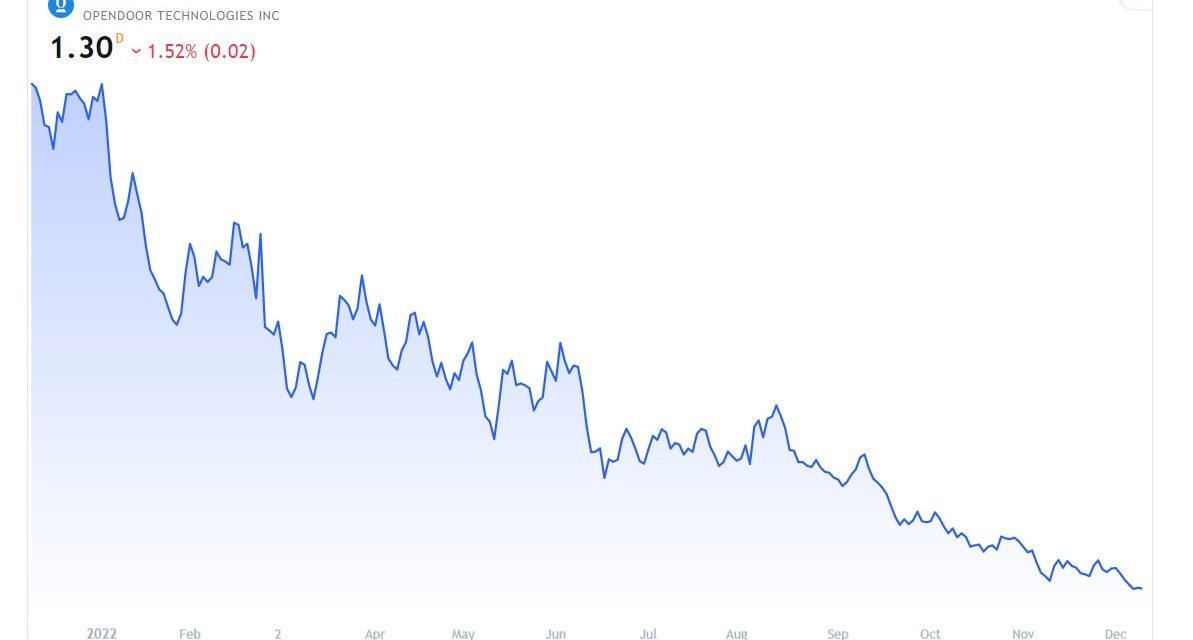

Opendoor Stock Chart

2022 YTD NASDAQ:OPEN Stock Price Trend as of December 9, 2022

YTD High: $11.56 on January 10; YTD Low: $1.30 on December 9

All Time High: $34.59 on February 8, 2021

Also see:

Opendoor’s iBuying Business Model

Opendoor’s current business model and the narrative executives sold to investors are faulty, in our opinion, and fail to work in the current economic environment. Interestingly, the business model was broken even when the real estate market was frothy, as evidenced by their inability to move properties profitably in very hot markets across the United States.

The model for lucrative flipping hinges on timing, speed and agility. Successful flippers reduce the time between their purchase and selling dates, while simultaneously reducing all expenses in between, as it is a notoriously low margin business that depends on volume for success. Reputable house flippers also add value by implementing strategic upgrades, making the property inherently more valuable than when it was purchased.

Opendoor competes in a low-margin, highly debt-leveraged business, a deadly combination if they have no other products to get them through the current housing slump and a precarious financial situation.

During an investor call, former CEO, Eric Wu, stated that the company’s goal was to break even on flipping activity, while creating profits from ancillary services. So far the company has not demonstrated that it can break even with its house flipping activity, nor generate enough ancillary business to make OPEN profitable.

Opendoor’s iBuying business model can be paraphrased as:

- Buy a property at a low price

- Make minor repairs

- Sell the property for a higher price, covering all costs associated with the sale

Keep in mind that this simplistic business model could be applied virtually to any kind of business by simply replacing the word “repairs” with “improvements”, such as:

- Buy a widget at a low price

- Make minor improvements

- Sell the widgets for a higher price, covering all costs associated with the sale

Seasoned investors would appreciate the even simpler version that could be applied to investing in stocks, which would only require two steps:

- Buy a stock at a low price

- Sell the stock for a higher price, covering all costs associated with the sale

We will revisit Opendoor’s “ABC” business model later in this article.

What to Know About AVMs (Automated Valuation Models)

At the heart of the class action complaint to Opendoor is their faulty AVM model. Though a lot of media outlets have been discussing Opendoor’s fate and future options, we have not seen a proliferation of discussions on their proprietary AVM, or AVM’s for iBuying in general.

AVMs have been used for decades in the real estate lending world, specifically at mortgage banks and other institutions that purchase real estate assets in the “secondary market” for investment purposes.

These statistical models are fed comparable sales, property characteristics, pricing and macroeconomic trends to provide fairly accurate estimates of the present day market value for a residential property. The resulting information is then used to either lend money to a buyer for a mortgage, or to purchase an asset for a company’s investment portfolio.

Most important for investors in AVM-dependent companies is to understand that no AVM is 100 percent accurate, even with “perfect information”. Much of the data entered into these AVMs are publicly available and can be drawn from assessor websites, property databases and other reliable sources.

The number of data points within an AVM or algorithm is crucial, as the more accurate the data provided, the more accurate the market valuation. AVM’s paint only part of a picture of a property’s value, however, and must be used in conjunction with a physical inspection and assessment of a property to arrive at a more realistic market valuation.

A critical element for a highly accurate and up-to-date AVM is to incorporate local tacit knowledge on the immediate neighborhood and the given property specifically. Examples of tacit knowledge is understanding the competitive advantage one home may have over many other similar homes (e.g. better lot; quieter street; more privacy; quieter setting; better neighbors; etc.).

When Problems Arise with Modeling Algorithms

Problems arise when the data used for a particular algorithm is inaccurate or is based on incorrect assumptions or is slow to adapt to changing circumstances. For example, if the data assumes that a particular home, “A”, is comparable in market value to a neighboring home, “B” that sold for $500,000 last month, it incorrectly assumes many facts that may not be in evidence.

In this scenario the AVM assumes that the micro- and macro-economic conditions during “A’s” sale are similar to those for “B”.

This brings up a valid point as one of the allegations in the Opendoor class action lawsuit is that the algorithm used to price home values was not capable of making market adjustments. The offering memorandum for the company’s IPO states:

Our pricing algorithms are designed to dynamically adjust to leading indicators and market conditions so that the business can react to real-time economic conditions. This responsiveness is critical to pricing accurately and maintaining margins, especially in periods of volatility.

One of the issues with Opendoor’s AVM or algorithm was that it did not adjust for failing or fluctuating real estate market conditions, which would have alerted executives to the impending implosion of the company’s real estate portfolio value.

Another issue, is that the statement above, which was approved by management, clearly overstates the benefits and competitive advantages of Opendoor’s proprietary AVM and data collection.

It is clear to any person who has perused the company’s financial statements, that the flaws in Opendoor’s algorithms were evident in almost every quarter of the company’s very short publicly traded history. For example, on November 2, 2022, Opendoor wrote down its inventory by $573M!

So, some questions that are on our minds include:

- Were company executives aware of the misinformation that they signed off on in the offering memorandum and stated during the investor “dog & pony show” meetings?

- Did executives even understand how the algorithm worked?

- Was the model tested with various scenarios, and were assumptions clearly stated?

If we were representing the interests of the investors, we would ask the leadership of Opendoor the following types of questions:

- How is Opendoor’s business model designed to succeed during both “peaks” and “valleys” of the residential real estate market? As we all know, real estate is cyclical in nature and timing is key to success.

- Is Opendoor planning to license their AVM to local market partners (e.g. Real Estate Brokerage Firms) to append “on-the-ground” tacit human data to further refine their models?

- Is Opendoor planning to partner with leading Pre-Sale-Renovation firms to improve their ability to add value to properties cost-effectively? (during stronger markets)

- Is Opendoor investigating ways to license their technology to local and regional iBuyers (AKA house flippers), to reduce their risks and the need for large sums of capital?

- Will Opendoor be redesigned to be more like Uber & Airbnb where they license technical solutions to independent iBuyers/House Flippers for them to run their businesses successfully, without having to own properties?

- How and when does Opendoor plan to propagate the adoption of residential digital twins to later be incorporated into their AVM, as well as integrate their AVM with digital twin smart cities?

Opendoor has been accused by some pundits of trying to transform homebuying into commodity buying. By not having on-the-ground expert eyes and ears to refine the valuation of a given property, iBuyers will be susceptible to misreading data as they lack critical local market intelligence.

One last point to keep in mind on Opendoor’s AVM is that the FTC declared that Opendoor employees manually adjusted their AVM generated assessed values:

Opendoor has used an automated system to generate expected market values for homes.

In many instances, Opendoor’s employees have manually adjusted these values before presenting them to consumers as offers.

Opendoor and the Future of iBuying

Evidenced by Zillow and Redfin’s exit from the iBuying business, it’s obvious that the low-margin, capital intensive needs are a risky drain to an iBuyer’s bottom line.

However, both Zillow and Redfin are better positioned to weather the economic doldrums of the real estate market, as they both have other well-established streams of income, and good reputations to support future growth.

On the contrary, Opendoor, who had visions of being “the Amazon of Real Estate“, is in another quadrant than other companies that offered an iBuying or “house-flipping” product. The company failed to grow its ancillary real estate services (e.g. home loans; cash-backed offers; digital title and escrow services; and services to buy and sell a home at the same time; etc.), as it relied heavily on house-flipping as a primary source of income.

Fast forward to 2022, where we see:

- Charges of deception, cheating and misleading customers by the FTC, resulting in a $62 million settlement

- A massive $573 million write down of the valuation of Opendoor’s inventory of unsold homes

- An 18% reduction in its already bloated workforce

- The reassignment of their CEO to a different role

In our opinion, Opendoor’s business model is rife with issues and faulty assumptions, and in its current state will not weather the economic and financial storm that will follow in 2023. Under the current business model there is no valid path to profitability. Executives will be distracted by legal issues, which will further decease focus on the company’s strategic priorities, including shoring up their reputation in the market.

Revisiting Opendoor’s “ABC” Business Model

Unfortunately, Opendoor’s “ABC” business model of buying properties at a low price, making minor repairs, and then selling at a price at a profit has not worked out as planned. Even in an incredibly hot real estate market, management was not effective in their approach to basic real estate investing.

Looking back at transactions from over 3 years ago, one can see that problems in Opendoor’s business model were already evident. Even during a strong sellers’ market, OPEN was selling properties at a loss, as they passed on lucrative opportunities and held fast to the results of their “algorithm”.

In many instances, properties were being offered to prospective sellers without any value-added renovations that could have increased its value and offering price.

The company’s overall cost structure appears incongruent to a “disruptive business”, with over 2,000 employees on the books, for a low-margin, software business, whose chief asset is a digital platform.

Even when Opendoor was fortunate enough to have averaged a per-unit-profit (e.g. Sales Price LESS Marketing Expenses LESS Buying Price), their overhead expenses eliminated their aggregate per-unit profit.

As the company transitions to offering other ancillary services, it will need to offer the best service in town, since there is nothing proprietary in these services. To date, we have seen few signs that Opendoor has achieved, even partially, Amazon’s high customer satisfaction levels, in their quest to be the “Amazon of Real Estate”.

Sadly, the reviews for the amount of real estate knowledge by those who have worked with OPEN’s employees are critical of their acumen and work ethic, as one realtor cautioned:

“Don’t call or leave a message after 2PM, they will get back to you the next day.”

Still another agent recalls, “Nobody works weekends“, which is prime time for realtors and their sales support staff.

Additionally, the current real estate economic cycle will not be kind to intermediaries in real estate transactions. The company’s potential buyer pool has been shrinking due to higher interest rates, job losses, and rising inflation. So it begs the question:

“To whom will they offload all of the inventory that they have purchased and at what price?”

Our conclusion from reviewing iBuying from a macro level, and the ease at which other players have transitioned to other products, leads us to believe that OPEN’s situation is isolated to their business model, leadership and poor market reputation.

Unless the company quickly retools its business model, and more importantly, improves customer satisfaction levels, there is little chance that the company can survive on its own.

We do believe, however, that there is a market for iBuyers, as homesellers will find that the convenience iBuying offers to be worth the service fees and lower offer than what they could have received with a traditional agent. Situations such as job transfers, probate sales, secondary investment properties, and out-of-market remote property owners are examples of where iBuyers can help property owners sell quickly and easily.

Unfortunately for investors, the size of the iBuyer market that can consistently return sufficient margins on sales may be significantly smaller than what was once thought.

There is a market for iBuyers who can execute the ABC model quickly, efficiently, professionally and consistently. Bloated payrolls, faulty algorithms, poor marketplace reputation, manual manipulations, untrustworthy business practices, and lack of real estate knowledge will not bode well for firms attempting to disrupt the market.

In retrospect, given their ideal target of homesellers need fast sales, we would have liked to have seen Opendoor take a more aggressive stance on reduced bids, while delivering on a promise of speed and no price haggling.

Ideally, Opendoor’s AVM could accurately identify home’s that represented minimal resale risk, based on an aggressively reduced asking price. In our opinion, Opendoor could have educated the marketplace that they were selling time and “financial freedom” by quickly eliminating one’s onerous mortgage.

An example provocative marketing statement could have had Opendoor lead with their known weakness (not getting the best price):

“When you sell to Opendoor, you will never get the best price, but you will get freedom at your convenience”

Quick and firm offers, that could be consistently executed, would have established Opendoor with a stronger, more trustworthy reputation. Instead, we sense that homesellers grew to expect both a near-market sales price and a quick sale, an unrealistic and untenable expectation for any company to meet.

The promise of offering market value prices is largely why Opendoor ran into trouble with the FTC.

We also suspect that Opendoor’s faulty AVM caused their staff to focus on other ways to shore up losses, which have hurt their market reputation. Two examples include being accused of “bait and switch” offers, and requiring homesellers to make questionable repairs or provide price concessions instead. Both of these scenarios cause friction, delays, loss of trust, and an overall a poor customer experience.

What Investors Should Know About Opendoor’s Current Situation

The blood-letting is not over for OPEN, as there is still one more quarter remaining that will reflect business transacted earlier that will have repercussions in the Q4 bottom line.

The company has not proven that they have a clear business model that will result in definitive, consistent profitability. Thus, until there is a restructuring of the business model and proof of sustainable profitable growth, the future of the company looks bleak.

Opendoor’s initial pivoting involves the launching of a residential real estate marketplace earlier than the company had previously planned. Opendoor’s marketplace will include both Opendoor-owned properties, as well as properties owned by third-parties.

A third-party marketplace approach is deemed as an “asset light” approach to earning revenue from transactions without having to own properties outright.

What Homeowners Should Know About Opendoor’s Current Situation

The biggest concern homeowners should have pertaining to Opendoor, and other iBuyers, is a rising percentage of homes owned by iBuyers for increasingly longer periods of time in their immediate communities.

This situation can arise when iBuyers have overpaid for housing inventory and are unable to resell at a profit and are then forced to offload at a loss in a fire-sale. Compounding the severity of this situation is that iBuyers are not considered to be effective marketers of individual properties and that iBuyers may take too long, on average, to adjust pricing downward to facilitate a quicker sale.

Both factors can lead to having vacant houses for extended periods of time, which will negatively impact valuations of nearby homes, while leading to neighborhood blight:

- An increasing number of vacant homes, which can lead to noticeable poor upkeep, neglect and potential crime

- A downward pricing shock on nearby comps if Opendoor offloads a large volume of homes in a short timeframe within the same market

- An increasing percentage of rental properties, which can cause valuations to decline, driven by mortgage lenders reducing the maximum loan amounts for which nearby homes can be approved

- An increase in Absentee Landlords which can cause the standard of living to decay within a local community, as there will be fewer residents vested in maintaining a safe, stable and well-kept environment from an investment perspective

- Opendoor properties can sit on the market significantly longer than traditionally listed homes, with a higher percentage of price reductions with minimal marketing support and a reputation for slow or no response to inquiries

Unoccupied Opendoor-Owned Sacramento Home For Sale Targeted By Squatters

Homeowners looking to sell using an iBuyer also need to be aware of what their marketing literature promises and the reality of working with these companies. For example, many realtors have expressed concerns that iBuyers do not adhere to standard listing protocols and requirements, such as disclosing known deficiencies or “word done” of a given property.

Opendoor specifically has been accused of using a blanket disclosure that they are unaware of known defects due to the “seller not living in the property”. They have also been accused of writing blanket “No’s” for a wide-range of common issues (e.g. settling issues, cracks, movement, wood rot, etc.) on properties they sell, which is unrealistic, especially for older homes.

On the other hand, Opendoor has also been accused of using comprehensive home inspections to obtain sizeable seller concessions in order to reduce their initial offer price. In other words, Opendoor can learn a lot about the defects of a property to justify a reduced offer price, while later claiming that they know little about the same listing due to “not living in the residence” when reselling it.

Example homeseller complaints shared on social media have included:

- Can decline to close, often just prior to the closing date

- Low ball offers

- Excessive fees for contingency repairs and/or large seller concession deductions on the sales price

- An addendum to the title contract that means the seller cannot sue for specific performance if Opendoor pulls out, even on the day of closing.

- Charging a 5% commission while stating to sellers that they do not have to pay a real estate agent commission

- Sales falling through at the last minute

- High fees

Example real estate agent complaints shared on social media have included:

- Can make deceitful initial offers at high prices to lure sellers in and then change negotiation tactics during the inspection process

- Cannot reliably schedule a showing for a buyer client for an Opendoor property online

- Offers low commissions to non-Opendoor agents

- Can offload work to the Buyer’s agents during a sale of their properties, as if it were a “For Sale by Owner” listing

- Can be difficult to receive a “list of work done” for a given property

Example homebuyer complaints shared on social media have included:

- Non-responsive communication on submitted bids

- Opendoor homes can be difficult to visit and may not be in the best presentable state

- Can let properties sit on the market for months without performing any upgrades

- Can change move-in dates multiple times

- Substandard repairs in their new home

The biggest concern homeowner communities should have is the impending threat of Opendoor resorting to sell a large volume of properties to an investor firm, like Blackstone, which could then turn them into single-family rental units. From a homeowner investor perspective, this would have a significant negative impact on the valuations of nearby homes.

Also see:

Our Thoughts on the Future of Opendoor & iBuying

Even with Opendoor’s recent price collapse of its publicly traded stock, there are still optimistic investors, who are convinced that the buying and selling of homes will be done primarily on the Internet with iBuying services within the next twenty years or so.

This opinion is largely fixated on the historic inefficiencies of the buying and selling process of homes and the time involved for the transaction to be completed. Another point of contention is the high commissions often extracted from a sale by real estate professionals, while providing dubious value-added services.

Concurrently, believers in the potential of iBuying tout the importance of data and AVMs to enable iBuyers to make smart purchases, while scaling efficiently.

Though we do not disagree with these points or the enormous opportunity for the residential real estate market to be improved, we remain very doubtful on Opendoor’s likelihood of turning their business around.

In short, we interpret Opendoor’s challenging situation as battling three formidable fronts simultaneously:

- A failed business model that needs to adapt quickly in order to grow new, more profitable revenue streams

- A softening residential real estate market

- A growing negative reputation amongst real estate professionals, homesellers, homebuyers, and perhaps soon, local homeowner communities with a high percentage of vacant Opendoor properties

We believe iBuyers like Opendoor, who have plans to become prominent national players, will eventually need to do some or all of the following, to weather dynamic markets and changing consumer preferences:

- Establish strategic partnerships with best-in-class local entities e.g.: real estate firms; pre-sale renovation firms; home services firms; lenders; local and regional iBuyers & House Flippers; etc.

- Grant access and incentives to local market professionals for them to provide valuable, hard-to-find local, tacit data into their AVM for improved depth, accuracy and intelligence, on an on-going basis

- License their improved, locally-enhanced AVM technology to local real estate professionals who represent buyers and sellers

- Diversify their business model beyond just residential real estate transactions, i.e. provide services either to real estate professionals, to homeowners directly, or a hybrid of both

- Provide these non-transactional services:

- Home Maintenance Services

- Home Inspection Services

- Homeowner Loyalty Membership Services

- Home Security Services

- Energy Efficiency Services & Performance Modeling

- Digital Twin Platform & Services

- Certifications of Home Quality with Reputable Third-Parties

- Advanced Homeselling Marketing Services & Technologies

- Provide a wide-range of diverse services then look to merge with a larger parent that has a family of complimentary home services companies

Lastly, we envision that whoever succeeds at becoming the dominant and most long-lasting iBuyer will need to resemble Google and Facebook in terms of acquiring massive amounts of accurate, free-flowing data.

Instead of tracking the behavior and preferences of digital users, iBuyers will need to track the traits, conditions and performance not only of individual properties (AKA Digital Twins), but also of neighborhoods, cities and local economies with which these homes connect.

Whoever can craft similar pervasive methods as that of Big Tech to persuade consumers and industry professionals to hand over and connect residential data sources willingly will be in the driver’s seat.

Legal Disclaimer: The information provided in this article and on this website does not, and is not intended to, constitute investment or legal advice; instead, all information, content, and materials available in this article and on this site are for general informational purposes only.

More Recommended Real Estate Reading

- What is a Turnkey Home in Today’s Market?

- Want the Best Mortgage Deal? Study APRs vs. Interest Rates!

- 8 Common Mistakes Made When Budgeting for a New Home

- What to Consider When Purchasing an Older or Historic Home

- 5 Examples of Older Homes Returning Maximum Profit with Renovations

- 4 Ways to Maximize Your Home’s Value

- 10 Conflicts of Interest Every Homeowner Should Know

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |