The term “zombie foreclosure” refers to a pre-foreclosure property that has been abandoned by its owner, usually after receiving a default notice from the lender, but the foreclosure process has not been completed. In other words, the property is still owned by the homeowner, however, they may be under the misguided belief that the property has reverted back to their mortgage lender.

For whatever reason, the bank may have canceled the foreclosure. Thus the property is left in limbo as the owner believes the bank owns the home, while the bank knows that the owner still has title.

In situations such as these, the property owner has moved out, making it difficult to track down the owner, leaving the property to deteriorate over time. Zombie foreclosures are on the rise once again in the US real estate market, with quarter-over-quarter growth since Q1 2022.

Prospective real estate buyers looking for a bargain can benefit from understanding the intricacies of zombie foreclosures and how to purchase such a home legally, as an easier, low cost pathway to homeownership.

Table of Contents

- Understanding Zombie Foreclosures

- The Rise of Zombie Foreclosures in 2023

- Opportunities for Prospective Buyers of Zombie Foreclosures

- How to Find Zombie Foreclosures

- How to Find the Owner of a Zombie Foreclosure

- The Risks of Considering a Zombie Foreclosure

Also see:

Understanding Zombie Foreclosures

Zombie foreclosures typically occur when the homeowner stops making mortgage payments, receives a notice of default from the lender, and then moves out of the property before the foreclosure process is completed.

This situation can happen for various reasons, such as the homeowner not being aware that the foreclosure process is still ongoing, or they prefer to pack up their belongings and leave before being forced out of the home. Further still, the owner may be underwater, owing more than the property is worth, and may not be in a financial situation to continue mortgage payments, so they just disappear.

The lender or mortgage bank then has the option to seize the property through a foreclosure auction, but in some cases, they may not complete the entire foreclosure process. Perhaps the lender realizes that the cost to turn the property over for sale is greater than the overall market value and decides to cease the foreclosure process.

When a foreclosure is not completed, the property title remains with the homeowner, even though they may have physically abandoned the home. Since the title of the property has not been legally transferred to the mortgage lender, who is in the process of foreclosing, the lender is not responsible for maintenance, upkeep, fees, or any legal obligations. This could leave the property in a state of disrepair, and it can become a magnet for crime, vandalism and squatters.

Unbeknownst to those homeowners abandoning their pre-foreclosure properties, an owner is still responsible for property taxes, HOA fees, financial upkeep, property maintenance, and is legally liable for any accidents occurring on the property, despite the ongoing foreclosure process.

The foreclosing lender is not obligated to locate the property owner to alert them that the foreclosure was not completed and that the owner still has title to the property.

Thus a “zombie” foreclosure property is born with each party believing that the property belongs to the other party.

The Rise of Zombie Foreclosures in 2023

The real estate market crash of 2008 and the subsequent economic recession led to a significant increase in foreclosures across the US with over 6 million homes lost to foreclosure. Many homeowners were unable to keep up with their mortgage payments, and lenders were forced to seize the properties through foreclosure auctions.

In many cases, property owners simply dropped off their keys to the bank, who had begun foreclosure proceedings. In other instances, homeowners, fled the area believing that their obligation to their lender had been met and that their real estate responsibilities had reverted back to the lender.

However, due to a backlog of foreclosure cases and other legal issues, many properties were left in limbo, with neither the original owner nor the lender taking possession. These properties became known as “zombie foreclosures,” and they continue to be a problem in many parts of the country.

While the zombie foreclosure issue exploded in 2008, the problem appears to be creeping back into certain areas within the US based on a recent report by ATTOM Data Solutions, a provider of nationwide property and real estate data and services.

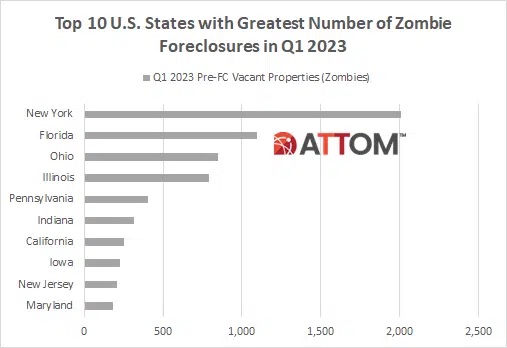

Image courtesy of ATTOM

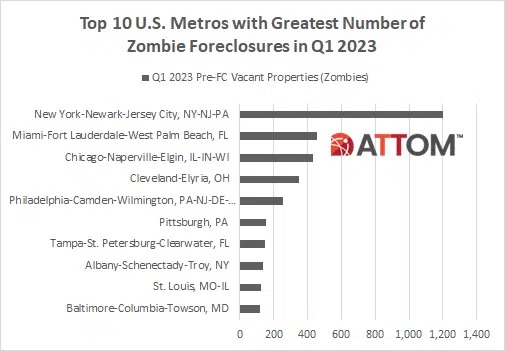

According to their latest report, a total of 8,141 residential properties facing possible foreclosure have been vacated by their owners nationwide in the first quarter of 2023, up slightly from 7,722 in the fourth quarter of 2022 and from 7,363 in the first quarter of 2022. In 2023, one of every 12,415 homes in the first quarter of 2023 is vacant and in some state of foreclosure.

Image courtesy of ATTOM

While the zombie foreclosure numbers are not yet as startling as they were in 2008, smart real estate investors looking to purchase these properties should track the trends and consider the opportunity.

For those interested in the Southern California residential real estate market, we recommend subscribing to Christian Walsh’s YouTube Channel. As an experienced Broker Associate at WIRE Associates, Berkshire Hathaway HomeServices, Walsh provides helpful updates on the Greater Los Angeles real estate market, including frequent updates on foreclosure trends. Here’s his most recent video:

Foreclosure Flood in SoCal? Is This a Start of the Foreclosure Wave?

We also expect the numbers of zombie foreclosures to continue to increase in the aftermath of historic high home prices and rising interest rates. Furthermore, moratoriums for foreclosures have been lifted in many parts of the United States, which will further accelerate the rate of foreclosures.

Opportunities for Prospective Buyers of Zombie Foreclosures

One of the biggest advantages of purchasing a zombie foreclosure is the potential for significant returns on investment. These properties are typically sold at a deep discount, which means that buyers can acquire them for a fraction of the cost of a comparable property in the same area. With some renovation work, buyers can turn these properties into attractive and profitable rentals or sell them for a significant profit.

However, buyers need to be aware that purchasing a zombie foreclosure comes with its own set of risks. The property may have been left vacant for an extended period, which means that it may have fallen into a state of deep disrepair. Renovations to plumbing, electrical, framework, foundation and roofing may be costly to bring the property back up to current building codes and in a habitable state. Potential investors should weigh the capital expense to renovate against the current market value of the property or the rental income that can be earned within a reasonable timeframe.

Additionally, buyers may face legal challenges when attempting to take ownership of the property. That’s because the original owner may have passed away, or cannot be located, making it difficult to obtain the necessary documentation to transfer ownership.

Despite the challenges associated with zombie foreclosures, there are opportunities for prospective buyers to take advantage and enjoy the rewards of homeownership at a fraction of the cost, with less buyer competition.

How to Find Zombie Foreclosures

Finding zombie foreclosures can be a challenge, as they are not always listed on traditional real estate websites or in the Multiple Listing Service (MLS). However, there are a few strategies that prospective buyers can use to locate these properties.

One option is to work with a real estate agent who specializes in foreclosures and distressed properties. These agents may have access to foreclosure listings that are not available to the general public, including zombie foreclosures.

Another option is to search public records for properties that are in some stage of foreclosure but have not been sold at auction. This approach can be a time-consuming process, but may yield some promising leads for prospective buyers.

A third option is to sign up for a premium property data service, such as ATTOM, which includes Zombie Foreclosures, among their wide-range of property data services and reports. Though their primary customer base consists of real estate brokers and investors, they offer an affordable monthly subscription for prospective homebuyers and small property investors that includes a free 7-day trial.

Additionally, you can search the following real estate sites and resources:

- Zillow.com

- RealtyTrac.com

- Foreclosure.com

- Classified Sections of Newspapers: Notices must be posted by law from the foreclosing lender

Finally, buyers can also reach out to lenders directly to inquire about zombie foreclosures or properties that have been served with a Notice of Default.

How to a Find the Owner of a Zombie Foreclosure

Once you’ve identified potential zombie foreclosure prospects the next step would be to reach out to the owner whose name appears on the property’s title documents. This can be accomplished in several ways.

- Local Tax Assessor’s Office

- Cyber Background Checks

- Fee-based Skip Tracing Databases

- Start a Letter Writing Campaign

Local Tax Assessor’s Office

Your local tax assessor’s office has information on every property in your county for property tax assessments and payment remittance. A simple call to the local tax assessor with the exact address or APN (Assessor’s Parcel Number) will get you the name, address, and in some cases, a phone number of the current owner of the property.

Since this is the official record for property taxation, this will likely be the most accurate information and the same information that feeds many of the pay sites with the exact same data.

Cyber Background Checks

Cyber Background Checks is a free search tool which provides information on properties throughout the US. Simply input the exact street address, city and state and the results will give you the names of any person who has resided at this address in the last 20 years.

Persons listed may be owners or tenants, but it’s a good way to begin your search. Cyber Background Checks can also be used to find the current address of the persons whose names appear at that particular address. In some cases, the results will yield a landline and cell phone number.

Fee-based Skip Tracing Databases

If you are a real estate professional, or have access to one, you might try other fee-based, skip tracing databases, such as PropStream.com or Foreclosure.com, both of which may charge for the same information that the county tax assessor will provide for free.

Start a Letter Writing Campaign

Once you are armed with the property owner’s contact information, you can begin your letter writing campaign, via US mail, explaining that you wish to purchase the property.

Christian Walsh recommends sending a reach-out letter to the property address labeled “Address Service Requested“, in order to get the owner’s new address. Walsh also suggests inquiring whether the owner would be interested in pursuing a “short sale” or equity sale (if they still have equity) with you as the buyer. He further advises that prospective buyers keep tracking the property to see if it eventually ends up going to foreclosure, and ultimately auction, where they can bid on the property, albeit with competition.

What are Zombie Foreclosures and How to Hunt for Zombie Foreclosures from Christian Walsh

The Risks of Considering a Zombie Foreclosure

Though the benefits of buying a zombie foreclosure are self-evident, assuming all things go smoothly. In short, you will be purchasing an under-appreciated asset that can be cost-effectively restored to its true value in a reasonable amount of time and effort.

Unforeseen risks, however, are another matter entirely. Here are several possible issues to expect when searching for and ultimately buying a Zombie Foreclosure property:

- Unclear legal standing of the property

- Outstanding liens on the property e.g. mechanics liens, property tax liens

- More extensive and costly home improvement upgrades

- Higher-than-normal homeowner insurance rates

Sometimes a property is in a state of foreclosure due to an insurmountable financial or legal situation that the current owner believes that they cannot overcome. It is imperative to perform thorough due diligence to understand the property’s entire financial picture.

A preliminary title search can help ensure that no existing liens are on the property or that the property does not have a “cloud on title” or lis pendens, also known as pending legal action.

A cloud or any type of legal encumbrance for monies owed to a third-party, may not be worth the effort, unless you can negotiate a settlement and initiate a quitclaim deed. By releasing a third party’s interest in the property you should be able to obtain clear title and be able to proceed unencumbered with a purchase.

Prospective buyers should also be sure to obtain a home insurance quote when considering purchasing a zombie foreclosure. Home insurance will protect the buyer from any unforeseen circumstances that may arise during the renovation process, such as theft, vandalism, or damage from natural disasters.

It’s important to note that home insurance for a zombie foreclosure property may be more expensive than for a traditional home due to the additional risks associated with the property. According to Verisk, a provider of data-driven insights to insurers, there is a direct correlation between increased claims and properties in the foreclosure process.

Zombie foreclosures can present opportunities for buyers who are willing to take on the risks associated with purchasing an abandoned property by doing their homework to find diamonds in the rough. However, buyers must be aware of the potential legal challenges and renovation costs that come with purchasing these types of properties.

More Recommended Home Buying Articles

- 8 Common Mistakes Made When Budgeting for a New Home

- 7 Questions to Ask Your Banker When Applying for a Home Loan

- Want the Best Mortgage Deal? Study APRs vs. Interest Rates!

- Proptech That Enables Homebuyers to Make All Cash Offers

- Green Mortgages: An Eco-Friendly Way to Combat Rising Interest Rates

- Want a Nontraditional House? Here’s How to Finance It!

- Real Estate Love Letters: Are They Legal?

- Options for Millennials Determined to Own a Home

- Enjoy Working Remotely? Here’s How to Choose to Live Wherever You Want

- Never Thought You’d Own Land? Think Again!

- Related Topics: Mortgages | Home Buying | Real Estate | Proptech

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |