Silver lining options and opportunities for Millennials determined to own a home, amongst dire findings from Apartment List’s 2022 Millennial Homeownership Report.

Millennials are in their prime home buying years of 25-to 40-years of age and find themselves competing for properties mainly against Baby Boomers, ages 57 to 72. The older generation is looking to downsize to homes in the same price and square footage range as Millennials, as they plan for their retirement years.

Older homebuyers typically have the advantage, since they often have significant equity in their current homes. Their large equity stakes equate to more buying power, which means they can afford to outbid competing offers from younger prospective buyers.

Though this scenario is just one of several challenges that many younger homebuyers are facing, all of these obstacles can be overcome with the right planning and disciplined approach.

Using the findings from the recent Apartment List’s 2022 Millennial Homeownership Report, in this article we present the current stark realities, with viable options for determined Millennials who are seeking a pathway to homeownership.

Table of Contents

- Dire News for Millennials Seeking Homeownership

- Underlying Challenges Millennials Need to Overcome

- How Millennials Can Overcome These Challenges

- New Opportunities for Millennial Homebuyers

- Innovative Home Buying Resources & Services

Also see:

- Enjoy Working Remotely? Here’s How to Choose to Live Wherever You Want

- Researching a Neighborhood: Frequently Asked Questions

- Never Thought You’d Own Land? Think Again!

- Proptech that Enables Homebuyers to Make All Cash Offers

- Additional Recommended Reading

- Related Topics: Home Buying | ADUs | Multigenerational Homes | Inspections | Monetization

Dire News for Millennials Seeking Homeownership

For those seeking a successful path to homeownership, the first step is to face your reality. Once you do, you may be relieved to learn that others may be in a more challenging situation than you are. Regardless, it is imperative to understand what your goals and a realistic timeframe to achieve these goals should be.

As you face these discouraging realities, be sure to counter these challenges with examples of people who have overcome arduous situations – preferably significantly worse than your circumstances. A terrific motivational driver is learning of an inspirational example and believing:

“If they could do it – so can I!”

That said, here are some eye-catching stats cited in Apartment List’s 2022 homeownership study:

Millennials’ Low Homeownership Rate Will Likely Persist

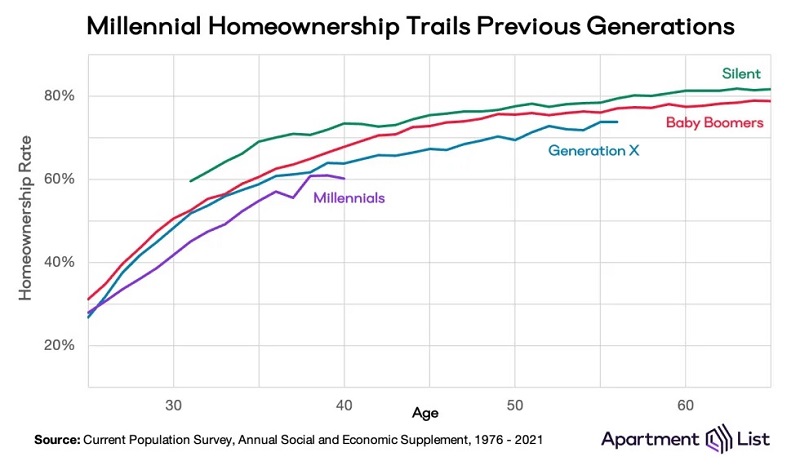

- Only 48.6% of Millennials currently own a home, this 20% lower than Gen X, and 30% lower than Baby Boomers

- Adjusted for the common age of 40, 60% of Millennials own homes, while at that same point in life, 64% of Gen Xers, 68% of Baby Boomers and 73% of Silents owned homes

- 22% of Millennials believe that they will never own a home, and view themselves as “Always Renters”

- Down payment savings rates remain shockingly low for Millennials who want to buy homes, with nearly 66% of Millennials having no savings whatsoever

- Only 16% have saved more than $10,000

- The average savings of just over $12,000 represents just a 4% down payment on a median-priced condo today.

Graph courtesy of Apartment List

Chart courtesy of Apartment List

Underlying Challenges Millennials Need to Overcome

The underlying drivers for the low homeownership rate of Millennials are largely the following intertwined trends:

- Rising Home Prices

- Competition Against Baby Boomers

- Stagnating Wages

- Low Saving Rates

- Poor Credit Scores

- Unrealistic Expectations

How Millennials Can Overcome These Challenges

Of these challenging trends, the three most important ones to focus on are:

These are areas in which you can make a direct impact, beginning immediately.

Unrealistic Expectations

By “unrealistic expectations”, we mean that it is imperative to understand the realities of your situation and identify what is and isn’t in your control to change to your advantage.

First, buying a home requires discipline, long-term planning, combined with developing detective skills to help you discover a “diamond in the rough”. Key to having “realistic expectations” is being open and flexible in your potential housing choices, such as:

- Moving to a more affordable location

- Moving to a location that has special homeownership incentives (e.g. for non-profit professions, such as law enforcement, teachers, firemen, remote workers, etc.)

- Reducing the requirements that you are seeking in a home: size, number rooms, age, yard size, etc.

- Setting a goal of buying a “starter” home, instead of a “forever” home

- Considering alternative housing structures or living arrangements, e.g. buy land & start small; condos; townhouses; live-work properties; tiny houses; multigenerational households; homesharing; duplexes with rental income; leasing to roommates; co-ownership contracts; and rent-to-own partnerships

- Forgoing contemporary turnkey amenities and aesthetics for an “ugly duckling” home with “good bones” (e.g. roofing, electrical, plumbing, foundation) that will last a lifetime with proper care and that can be beautified over time

Another aspect of ridding unrealistic expectations is to accept that “you cannot have it all”. A lifestyle of “luxurious convenience” (e.g. daily lattes, frequent dining out, high dry cleaning bills, personal travel, etc.) runs counter to a lifestyle of “disciplined sacrifice” that most prospective homebuyers of ALL generations have taken.

Though virtually all homebuyers are aware that saving for a deposit is a prerequisite, having ample savings and earnings are not a cure all for homeownership. While worrying about your future prospects, you may feel some relief to know that there have been many examples of homeowners, with large savings and incomes, that later encountered financial setbacks from buying a home that was outside of their “financial comfort zone”, was overvalued, or both.

Poor Credit Scores

To add further bad news to the Millennial homeownership plight, the average credit score for today’s homebuyer is 745, yet the average Millennial FICO score is 667.

The first step to improving your credit score is to understand what impacts your credit both negatively and positively. Here are several tips that will help you improve your score:

- Free credit score services to monitor and understand why your score may improve or decrease

- Dispute any errors

- Make on-time payments

- Pay off your credit card debt as quickly as possible

- New services and programs that can help renters build their credit history and scores

- Own as few credit cards as possible, and maintain a clean credit history. Refrain from signing up for cards which offer a free gift or other perquisite just for signing up, even if you do not intend to use the card. Just owning the card represents “potential debt” which has a negative impact on your credit.

- Two credit cards with a five year history is better than four cards that you had held for a short stint.

- Make sure you understand and track the same score as do Mortgage Lenders

- Look for Mortgage Lenders that offer a process to help you improve your score for better rates, with partners like CreditXpert

- If you are not approved for a mortgage loan, reach out to the lender to ask them to help you understand how you can be approved in the future. Set goals to reach those benchmarks.

- Look into credible services that help improve your credit score, such as: FICO Ultra; Experian Boost; and CreditXpert Wayfinder.

Low Saving Rates

According to Apartment List, 52% of non-home owning millennials aren’t saving for a down payment. Keep in mind that even high-earning individuals can have low saving rates, if they are undisciplined with their spending habits.

The key to improving your saving rate is to set achievable, realistic goals. The first step is to identify and reduce all unnecessary expenses that can be added to your savings goal.

For the first six months, set a target of a modest percentage (e.g. 5%) of your take-home income, as part of your savings goal. Once you see the lump sum accruing, you will become encouraged to meet more improved goals (e.g. 10 to 15%).

As your down payment amount increases, you will find that it becomes easier to save with practice. Former “luxury” items, like lattes or weekly mani-pedis, will soon be forgotten. Keep your eyes on the prize!

As a result, your improved savings rate can help boost your credit score, as it demonstrates a better overall liquidity situation for your account.

Part of this process is learning to enjoy being a frugal and wise consumer. When setting your mind towards increasing savings and lowering expenses, you will be amazed at your results!

New Opportunities for Millennial Homebuyers

The really good news for prospective Millennial homebuyers is that there are many entrepreneurs that are actively addressing challenges to affordable homeownership.

Their combined efforts are offering options that did not exist for previous generations.

For those facing the most difficult situations, we strongly recommend searching for new firms and services that are addressing your key challenges, such as:

- Improving Your Credit Score

- Helping Renters Become Homeowners (e.g. Rent-to-Own programs)

- Finding more affordable rental housing in the interim

- Finding more cost-effective construction methods and home types (e.g. Boxabl Casitas)

- Local or state-wide incentive programs that are attracting homeowners and remote workers

Remote Work Opportunities

In fact the increasing opportunities for remote work will play a critical factor in helping prospective homebuyers find affordable real estate. This opportunity is unprecedented.

Just as it is possible for workers to pivot into more lucrative and stable professions, we strongly recommend further developing your skill set to remain in high-demand in a growing economy as part of the remote workforce.

Buy Land & Start “Tiny”

With the opportunity to work remotely, is the combined opportunity of purchasing land and starting with an affordable, tiny house structure.

If we were giving advice to our twenty-year-old selves, we would say “Buy Land“. Land is one of those commodities that had both intrinsic and financial value, if you buy in an area that will prosper in the next 10 years.

Since many adults in their twenties, maybe even in their 30’s, have not yet decided where they will settle down, this advice seems too vague. Yet the beauty of owning land is that someone else may find value in your purchase later on and you now own a marketable asset.

Opportunities to Monetize Your Future Home

Another beneficial trends is that more local zoning authorities will likely loosen their zoning laws that will expand how a home is both used and monetized. The ability to earn incremental income from your home is invaluable for less certain futures.

Creative and flexible ways to earn money from our home (e.g. long-term and short-term rental income; storage income; home businesses; etc.) will lessen the financial risk and burdens of owning a home.

Keep in mind that being able to purchase a home is just the first step of homeownership. Unfortunately many homeowners can encounter setbacks that cause them to lose their homes. Be sure to plan upfront to do everything in your power to increase the chances of a stable and enjoyable experience of homeownership.

Innovative Home Buying Resources & Services

Here are example companies that are helping prospective homebuyers become homeowners.

Credit Score Improvement Services

Home Buying Resources

- Divvy: Down Payment Program for Renters

- Home Partners: Flexible Lease-to-Buy Opportunities for Listed Homes

- RentBeforeOwning.com: Lease-to-Buy Opportunities Between Renters and Property Owners

- Hurry Home: Helping Renters Become Homeowners

- ZeroDown: Try Before You Buy

- CoBuy: Joint Financing Homeownership

- Enjoy Working Remotely? Here’s How to Choose to Live Wherever You Want

- Firms that Help Homebuyers Make All Cash Offers

- Want a Nontraditional House? Here’s How to Finance It!

- Want to Buy a Fixer-Upper, But Lack the Funds? Consider a 203K Loan!

Resources for Affordable Rentals

- : An online rental marketplace to find your ideal apartment

- Esusu: Help for Renters to Build Their Credit Histories & Scores

- PadSplit: Affordable Rental Solutions to Help Renters Save Income

- Cirtru: Rooms & Houses for Rent

- Senior Homeshares: Shared Housing for Senior Residents

- Silvernest: Shared Housing for Senior Residents

- Roomgo: Rooms for Rent

- Bungalow: Shared Housing for Rent

Alternate Prefab Tiny House Construction

- Boxabl: Modular Tiny Houses that can scale

- Cover: Prefab ADUs

- Dwellito: Marketplace of small, prefab modular homes

- Modal: Prefab ADUs

- Roombus: Prefab ADUs

Additional Recommended Reading

- Enjoy Working Remotely? Here’s How to Choose to Live Wherever You Want

- 10 Creative Ways to Monetize Your Home

- Researching a Neighborhood: Frequently Asked Questions

- Current Home Building and Buying Trends

- Never Thought You’d Own Land? Think Again!

- Proptech that Enables Homebuyers to Make All Cash Offers

- Home Inspection Technologies to Alleviate Your Purchase Anxiety

- Want to Buy a Fixer-Upper, But Lack the Funds? Consider a 203K Loan!

- Homebuyer Beware: The Perils of Flipped Homes

- Top Prefab ADU Companies

- Never Though You’d Live in a Multigenerational Home? Think Again!

- Want a Nontraditional House? Here’s How to Finance It!

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |