Article last updated on April 10, 2024 and initially published on December 1, 2022

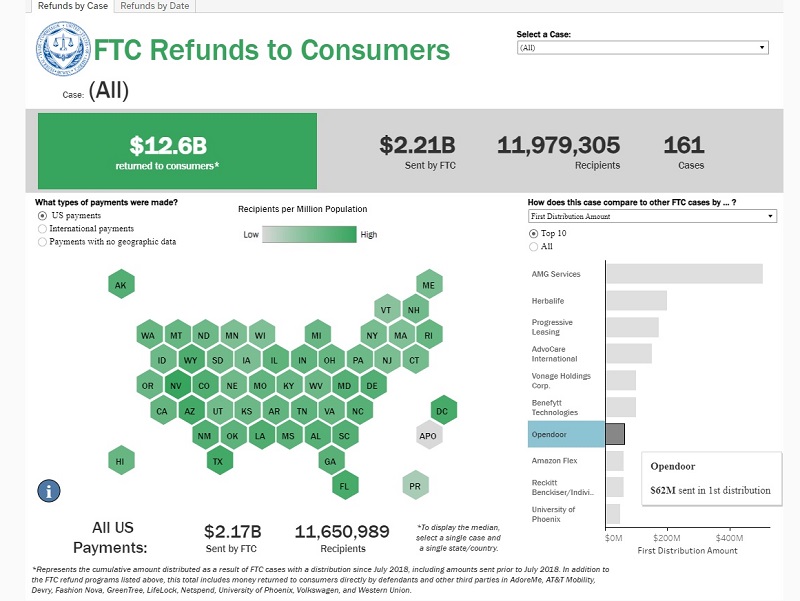

UPDATE: Details on the April 3, 2024 FTC $62M refund payments to Opendoor customers can be found in the timeline below.

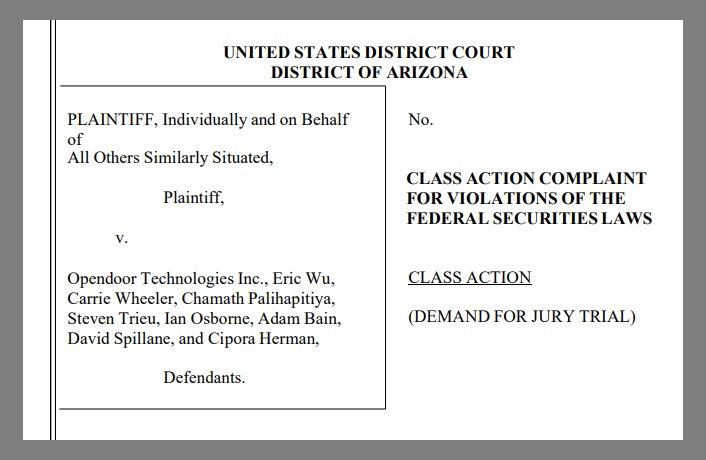

The pending investor class action lawsuit against Opendoor continues to gain more attention. The lawsuit was filed in October 2022 in the Federal District of Arizona, where Opendoor has maintained a strong market presence. The deadline for applying as the lead plaintiff was Tuesday, December 6, 2022.

Opendoor and a group of individual defendants are being accused of securities fraud. Understanding Opendoor’s perilous situation can be instructive for other investors in iBuyer securities, as well as for homeowners who are contemplating using similar iBuyer services, especially during a real estate market downturn.

Here are the key facts and circumstances of the case to date.

Table of Contents

- About Opendoor

- Opendoor Timeline of Events

- Details of the Class Action Securities Lawsuit Against Opendoor

- Defendants Named in the Opendoor Securities Fraud Lawsuit

- Who Can Join the Class Action Lawsuit Against Opendoor

- Related Links on the Opendoor Lawsuit

Also see:

- How to Profit from the Misfortunes of Opendoor & Other iBuyers

- What does Opendoor’s Situation Mean for the Future of iBuying?

- Homebuyer Beware: The Perils of Flipped Homes

- 7 Expert Tips on Using Virtual Staging to Sell Your Home Quickly

- Why Digital Twins are the Future of Homeownership

- More Recommended Real Estate Reading

- Related Topics: Home Buying | Home Selling | Virtual Staging | Pre-Sale Renovations

About Opendoor

Opendoor operates a digital platform to facilitate the efficient buying and selling of residential real estate in the United States. The company’s platform features a technology commonly known as “iBuying,” which is an algorithm-based process with the mission of making market-based offers to sellers for their homes, and then flipping those homes to buyers for a profit. These algorithms are commonly referred to as AVMs – Automated Valuation Models.

Opendoor was formerly known as Social Capital Hedosophia Holdings Corp. II (“SCH”), which operated as a special purpose acquisition company (SPAC), also referred to as a blank-check company. A SPAC has no specific business plan or purpose, and usually is involved in speculative investments, including mergers and acquisitions.

On September 15, 2020, Opendoor, then still operating as SCH, merged with Opendoor Labs, to create an enterprise valuation of $4.8 billion. The newly formed Opendoor Technologies, Inc. later offered additional shares to the market via secondary public offerings in February 2021 and September 2021.

Image courtesy of Opendoor.

Opendoor Timeline of Events

Also see:

April 3, 2024

Details on the $62M FTC Refund Payments to Opendoor Customers

- FTC Sends Nearly $62 Million in Refunds to Sellers Deceived by Opendoor

- The FTC sends refund checks, worth an approximate average of $1,134, to 54,689 eligible homeowners who sold their home to Opendoor

- Eligible homeowners must have sold a home to Opendoor on or before July 29, 2022 and either received less than market value or paid a service free greater than 6% of the home’s sale price

- Homeowners who sold a home to Opendoor after July 29, 2022 are not eligible to receive a refund

- Consumers who purchased a home from Opendoor are also not eligible to receive a refund

- Recipients should cash their checks within 90 days, as indicated on individual checks

- Legal Rights: The FTC does not require you to forfeit any rights you may have under Federal or State law if you accept a refund

- Beware of Scams: The FTC never requires people to pay money or provide account information to get a refund

- Consumers who have questions about their payment should contact the refund administrator, Epiq Systems, at 1-888-546-2054 or visit the FTC website to view Frequently Asked Questions about the refund process

- Opendoor’s stock price closes at $2.87

FTC Top 10 Refunds to Consumers since July 2018 as of April 5, 2024

February 15, 2024

- Opendoor announces a net loss of $275M for the full year of 2023, versus a net loss of $1.4B for the full year of 2022

- Opendoor’s stock price closes at $3.35

April 18, 2023

- Opendoor Lays Off 22% of Its Workforce

- Opendoor’s stock price closes at $1.66

February 23, 2023

- Opendoor announces a net loss of $399M in Q4 of 2022, versus a net loss of $191M in Q4 of 2021

December 1, 2022

- CEO Eric Wu steps down in light of the company’s housing market woes

- Opendoor appoints CFO Carrie Wheeler to CEO

- Opendoor’s stock price closes at $1.85

Carrie Wheeler, New CEO of Opendoor

November 7, 2022

- Mike DelPrete publishes his analysis on Opendoor’s Q3 2022 financial performance – One Year Later: Zillow Offers & Opendoor – opining that Zillow made the correct decision to shut down its iBuying business, Zillow Offers, whereas Opendoor has no choice but to continue on in a challenging and volatile market

November 2, 2022

- Opendoor announces losses of $928M in Q3 of 2022

- Opendoor writes down its inventory by $573M

- Opendoor Lays Off 18% of Workforce (550 Employees)

- Opendoor shuts down its Opendoor Finance (OD Homes Brokerage + Opendoor Home Loans) mortgage business

- CEO and Co-Founder, Eric Wu sends email message to company staff after announcing lay offs

- CEO Wu classifies situation as “one of the most challenging real estate markets in 40 years“

October 7, 2022

September 22, 2022

September 19, 2022

- Bloomberg publishes findings that document the failure of Opendoor’s algorithm to adjust accurately to changing market conditions

August 1, 2022

July 22, 2022

- A licensed real estate agent starts a thread on Reddit asking if OpenDoor could be subject to a class-action lawsuit for not disclosing material facts

April 15, 2022

Q1 2022

- Opendoor’s stock price falls due to a softer-than-expected Q1 2022

March 10, 2022

February 24, 2022

November 2, 2021

- Zillow shuts down Zillow Offers, its iBuying business, after losing $422M in Q3 2021

February 8, 2021

- Opendoor hits its all-time-high stock price of $34.59

December 21, 2020

- Opendoor has its IPO (Initial Public Offering) with a share price of $31.47

September 15, 2020

- Opendoor Technologies, Inc. is formed from the merger of Social Capital Hedosophia Holdings Corp. II and Opendoor Labs, Inc.

April 15, 2020

March 20, 2019

- Opendoor raises $300M in venture capital, including Khosla Ventures, giving them a valuation of $3.8B

September 27, 2018

- Opendoor raises $400M in venture capital from SoftBank Vision Fund

June 13, 2018

- Opendoor raises a $325M in venture capital from General Atlantic

December 1, 2016

- Opendoor raises a $210M in venture capital from Norwest Venture Partners

May 2014

- Opendoor raises $9.95M in venture capital, led by Khosla Ventures

March 2014

- Opendoor is launched by founders Eric Wu, Keith Rabois, JD Ross and Ian Wong

Details of the Class Action Investor Complaint Against Opendoor

The lawsuit on behalf of Opendoor investors commenced in the United States District Court for the District of Arizona, when filed in early October 2022. The lawsuit alleges violations of the Securities Act of 1933 and the Securities Exchange Act of 1934.

The lead plaintiff deadline is December 6, 2022 with the Class Period defined as December 21, 2020 through September 16, 2022. In other words, if you purchased Opendoor stock during this period you would be eligible to join and potentially lead this lawsuit.

The lawsuit seeks to recover losses on behalf of Opendoor investors who were adversely affected by alleged securities fraud during the defined Class Period.

The NASDAQ traded stock “OPEN” had plummeted from a high of $34.59 in February 2021 to a low of $1.85 at close of the initial publishing date of this article: December 1, 2022.

Opendoor Class Action Lawsuit Accusations

The complaint filed specifically alleges that, throughout the Class Period, the named defendants failed to disclose the following information to investors:

- The algorithm used by Opendoor to make purchase offers for homes could not accurately adjust to changing house prices across different market conditions and economic cycles

- As a result, Opendoor was at an increased risk of sustaining significant and repeated losses due to residential real estate pricing fluctuations

- Accordingly, the defendants overstated the purported benefits and competitive advantages of the algorithm; and

- As a result, the defendants’ positive statements about Opendoor’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis at all relevant times.

For more details on the complaint, see:

Defendants Named in the Opendoor Securities Fraud Lawsuit

- Opendoor Technologies, Inc.

- Eric Wu, Co-Founder and Former CEO, Opendoor, Former Board Chairperson

- Carrie Wheeler, CFO, Opendoor, and newly appointed CEO, Opendoor

- Chamath Palihapitiya, CEO, Social Capital LP

- Steven Trieu, CFO, Social Capital LP

- Ian Osborne, CEO, Hedosophia

- Adam Bain, Managing Partner, 01 Advisors, Board Member

- David Spillane, Board Member of Social Capital LP/Hedosophia

- Cipora Herman, Board Member

Eric Wu, former CEO of Opendoor

Who Can Join the Class Action Lawsuit Against Opendoor?

To be a member of this lawsuit it is not necessary to take any action at this time.

Interested and qualified persons may retain counsel of their choice or take no action and remain an absent member of the class action.

If you wish to learn more about this class action, or if you have any questions concerning this announcement or your rights or interests, with respect to the pending class action lawsuit, there are several law firms actively seeking a lead plaintiff that you can contact:

- Bragar Eagel & Squire, P.C.

- Johnson Fistel, LLP

- Bernstein Liebhard LLP

- Levi & Korsinsky

- The Schall Law Firm

- Kessler Topaz Meltzer & Check, LLP

- Law Offices of Howard G. Smith

- Robbins Geller Rudman & Dowd LLP

- Wolf Haldenstein Adler Freeman & Herz LLP

Related Links on the Opendoor Lawsuit & Financial Performance

- Opendoor Lawsuit Complaint

- Opendoor Investor Relations

- Opendoor Board of Directors

- One Year Later: Zillow Offers & Opendoor (Mike DelPrete on Opendoor’s Q3 2022 financial performance)

- Opendoor Historic Company Stats: Revenue & Market Share (as of August 1, 2022)

- An Interview with Opendoor CEO Eric Wu About Building a Marketplace in a Real Estate Slowdown

- Opendoor Recent News & Activity

- Reddit Thread: Do you think OpenDoor could be subject to a class-action lawsuit for not disclosing material facts?

- Opendoor Trustpilot Reviews

More Recommended Real Estate Reading

- What is a Turnkey Home in Today’s Market?

- Want the Best Mortgage Deal? Study APRs vs. Interest Rates!

- 8 Common Mistakes Made When Budgeting for a New Home

- What to Consider When Purchasing an Older or Historic Home

- 5 Examples of Older Homes Returning Maximum Profit with Renovations

- 4 Ways to Maximize Your Home’s Value

- 10 Conflicts of Interest Every Homeowner Should Know

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |