Buying a home can be a complicated experience on the best of days, so approaching the process armed with knowledge is crucial. Being familiar with the ins and outs, requirements, and terminology involved can pay off in a big way. For example:

- Is the housing inventory high or low, and in which direction is it moving?

- How about interest rates?

- Is the market in a given city or state heating up or cooling off?

These important topics represent just the tip of the home buying iceberg, and like it or not, most of what’s beneath the surface is related to financial matters. Furthermore, the use of real estate terminology – especially concerning mortgages and finances – can be inaccurate and imprecise.

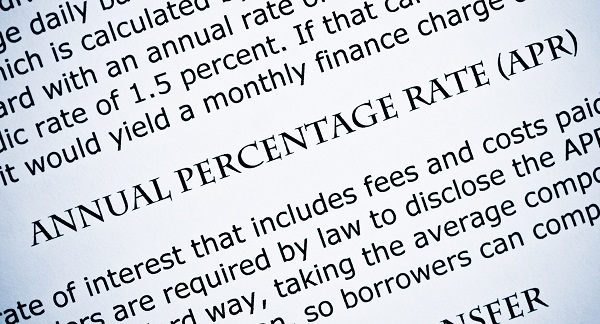

An unfortunate reality is that many homebuyers find that understanding all of the different aspects of a mortgage loan can make it even more confusing. Two terms often used interchangeably when discussing mortgage loans are Interest Rate and Annual Percentage Rate (APR).

However, despite their relativity, these two terms have very different meanings, and understanding them will pay off for homeowners, especially as you seek to find the right mortgage for you.

To get the best mortgage deal, here’s what you need to understand.

Table of Contents

- What is a Mortgage Interest Rate?

- What is APR and How is It Calculated?

- How do the Two Rates Compare for Consumers?

- Which Rate Should You Focus on When Shopping for a Mortgage Loan?

- How to Get the Best Mortgage Deal

- Closing Comments: Two Sides of the Same Coin But With Different Values

Also see:

What is a Mortgage Interest Rate?

A mortgage interest rate, expressed as a percentage, is the cost of borrowing money for a home loan. The mortgage interest rate is the percentage of the loan that the lender charges for borrowing money. For example, if you’re considering a $200,000 loan with a 4% interest rate, your annual interest expense for the first year of the loan would be just shy of $8,000, at $7,936, which would equate to an average interest payment of $661 per month.

Your mortgage interest rate is an extremely important figure, but if you count on this percentage alone when budgeting for your new home, you’ll run into trouble. Not accounting for the extra costs associated with buying a home is one of the biggest mistakes made when budgeting for a home. This will become clear once you understand mortgage interest rates in the context of annual percentage rates.

What is APR and How is It Calculated?

The Annual Percentage Rate (APR) on a loan is a figure that reflects the total cost of borrowing money for a purchase, including:

- Interest Paid

- Points Paid Upfront

- Other Associated Expenses & Fees

For example, if you’re considering a $200,000 loan with a 4% interest rate and $3,000 in closing costs paid upfront, your APR would be 4.15%. Your monthly interest expense would still average $661 in the first year, but the APR includes the one-time closing costs.

Since it’s a more accurate reflection of the cost of borrowing money, the APR is generally higher than the interest rate on a loan. In fact, lenders are required by law to disclose the APR to potential borrowers.

So, why use the interest rate when the APR reflects more accurately what you’ll actually pay?

The answer has to do with how lenders use the different terms.

How do the Two Rates Compare for Consumers?

While your interest rate is important, the APR can give you a better idea of your total monthly payments. The APR includes:

- The Interest Rate

- Points paid upfront

- Broker Fees, and

- Other Credit Charges required to get the loan

The APR is always higher than the interest rate on a loan because it includes these additional costs. In some cases, the APR on a loan can be more than double the interest rate!

To compare loans, look at both the interest rate and the APR. The lower the APR, the less you’ll pay in interest and other fees over time.

Remember that the interest rate is only one factor in choosing a loan. Other factors, such as the length of the loan, the size of your down payment, your credit score and the fees associated with the loan can also impact the cost of borrowing money.

If you’re unsure which type of loan is right for you, talk to a lender about your options.

Which Rate Should You Focus on When Shopping for a Mortgage Loan?

When shopping for a mortgage loan, it’s important to compare the interest rate and the APR. Both rates tell you, as a homebuyer, a lot about the mortgage loan you’re taking out. A reasonable interest rate combined with higher-than-normal fees can result in a high APR.

The bottom line:

When comparing loans, be sure to look at both the interest rate and the APR.

How to Get the Best Mortgage Deal

Negotiating is key when it comes to getting the best deal on your mortgage loan interest rate and APR.

Here are a few tips:

- Know Your Credit Score: Your credit score will impact the interest rate you’re offered.

- Shop Around: Compare rates from multiple lenders to get an idea of what’s available.

- Ask About Fees: Some lenders charge higher fees than others.

- Don’t be Afraid to Negotiate: Lenders are often willing to lower rates and fees if it means getting your business.

If you’re unsure where to start, talk to a mortgage broker about your options. They can help you compare rates and fees from multiple lenders and find the best deal for you.

Closing Comments: Two Sides of the Same Coin But With Different Values

Mortgage Interest Rates and Annual Percentage Rates can be confusing and intimidating, but understanding the difference between them is essential for potential homebuyers. Armed with this knowledge, you’ll be able to move forward confidently and successfully in your homeownership journey!

More Recommended Home Buying Articles

- Proptech That Enables Homebuyers to Make All Cash Offers

- Green Mortgages: An Eco-Friendly Way to Combat Rising Interest Rates

- Want a Nontraditional House? Here’s How to Finance It!

- Real Estate Love Letters: Are They Legal?

- Options for Millennials Determined to Own a Home

- Enjoy Working Remotely? Here’s How to Choose to Live Wherever You Want

- Never Thought You’d Own Land? Think Again!

- Related Topics: Mortgages | Home Buying | Real Estate | Proptech

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |