Buying a home, especially for the first time, can be an intimidating and overwhelming process. Factoring in various financing options can add further layers of confusion. When it comes to considering mortgage loans, it’s a common reaction to feel as if there are too many choices!

To ward off these apprehensions, first-time homebuyers should familiarize themselves with the different available mortgage options, before starting the house-hunting process!

Here is an overview of the most common first-time homebuyer mortgage programs that will enable you purchase a home ideally suited for your current needs.

4 Most Common Mortgage Options for First-Time Homebuyers

Also see:

1. Conventional Loans

Conventional loans are the most common type of mortgage. Approximately 70% to 75% of buyers choose conventional mortgages to finance their home purchases. These loans are not backed by the U.S. Government, but conforming conventional loans are, however, backed by the U.S. sanctioned Fannie Mae and Freddie Mac organizations.

NOTE: All conforming loans are conventional loans, but not all conventional loans are conforming. Conforming loans adhere to Fannie Mae and Freddie Mac underwriting requirements and present less risk to lenders, as they can be sold back to Fannie Mae and Freddie Mac, or sold in packages to institutional investors as mortgage-backed securities. Non-conforming conventional loans, such as Jumbo Loans, are considered more risky to lenders and are typically more costly than conforming loans.

Loans that are within the Fannie Mae program can offer conventional loans with just a 3% down payment, often referred to as a “97 LTV loan”. How it works is Fannie Mae purchases conventional mortgages from large, commercial banks that are not insured by the U.S. government. This process doesn’t impact the borrower in any direct day-to-day fashion.

- Advantages of Conventional Loans

- Disadvantages of Conventional Loans

- First-Time Homebuyers Best-Suited for a Conventional Loan

Advantages of Conventional Loans

- A larger pool of mortgage lenders from which to choose

- Higher mortgage limits for non-conforming conventional loans (e.g. jumbo loans)

- Loans can be approved more quickly than government-backed loans

- Typically less costly than loans that are guaranteed by the federal government

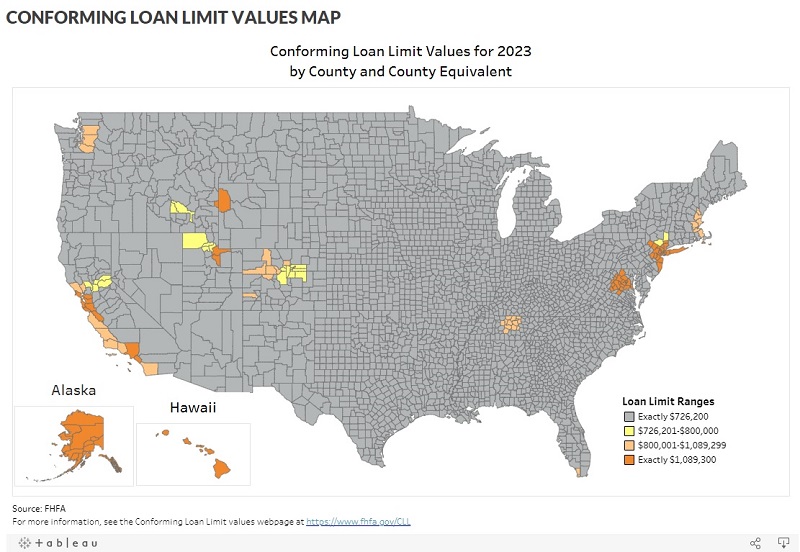

- Conforming loan limit values (CLLs) have continued to increase: $726,200 for most US locations and $1,089,300 in qualifying high-cost areas

- More flexibility and options, including:

- Wide variety of terms (e.g. 10-year; 15-year; 30-year; and more)

- Ability to forego an escrow account for property taxes and homeowner insurance, giving you direct control over these critical annual responsibilities

- Fixed interest rates or adjustable rates (e.g. ARMs)

- Can be used for primary and secondary residences

- Fewer restrictions than government programs, e.g.: property location; property type; income; etc.

- No prepayment penalty

Image courtesy of Federal Housing Finance Agency

Disadvantages of Conventional Loans

- Higher credit score requirements

- Larger down payment is often required

- Stricter qualifications than Government-backed mortgage programs

- Potential PMI requirements if you put down less than 20%

- No assistance programs available

- Most conventional mortgages are not assumable

- If you need to purchase a home for a greater amount than the current Freddie Mac confirming loan limit, you will need to apply for a more costly jumbo loan

First-Time Homebuyers Best-Suited for a Conventional Loan

Prospective first-time homebuyers that have most of the following traits or preferences should strongly consider applying for a conventional loan:

- High, steady income

- Higher minimum credit score (e.g. 620 for conforming loans)

- Lower maximum debt-to-income ratio (e.g. 43% for conforming loans)

- Large down payment amount on hand (e.g. 20% or greater)

- Preference for a large, more costly house

- Needs flexibility when choosing a property, e.g.: location; home type;

- Needs flexibility when choosing a mortgage, e.g.: loan term; maximum amount; rate type; lower interest rate; etc.

In other words, first-time homebuyers that project strong credit-worthiness will have negotiating power to obtain the best mortgage rates, upfront credits, and flexibility to purchase a home well-suited to their needs.

2. FHA Loans

FHA loans are backed by the Federal Housing Administration. These loans are perfect for people who don’t have strong credit, are just beginning their credit journey, or don’t have the traditional 20% down payment. How it works is, this government agency guarantees a portion of the mortgage, which gives lenders more confidence to approve an individual’s mortgage application. Borrowers can qualify for as little as 3.5% down.

- Advantages of FHA Loans

- Disadvantages of FHA Loans

- First-Time Homebuyers Best-Suited for an FHA Loan

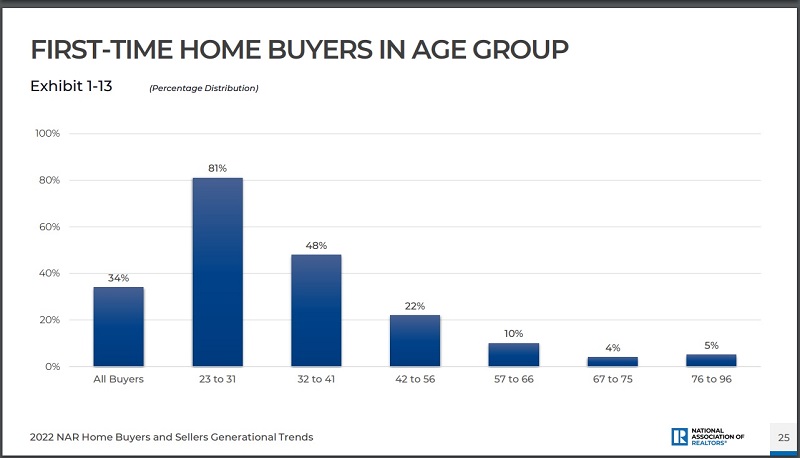

Image courtesy of NAR

Advantages of FHA Loans

- Easier to qualify for a mortgage, especially buyers who are young, have short credit histories, and lack substantial cash reserves and assets

- Loans are assumable: a buyer can take over your FHA mortgage and keep the same interest rate and terms

- Easier and less expensive to refinance than conventional loans

- Increased loan limits for properties located in high-cost areas (currently $1,089,300)

- More accommodating requirements, including:

- Lower down payments

- Flexible credit requirements

- Lower interest rates

- Higher debt-to-income ratios

- Can finance the Up-Front Mortgage Insurance (UFMI) payment into your mortgage

Disadvantages of FHA Loans

- Lower loan limits than conventional mortgages (currently $472,030 for properties not in high-cost areas)

- Properties must meet certain safety and livability standards

- Mandatory monthly PMI (Private Mortgage Insurance) payments until a 20% equity stake has been reached

- Fewer term options (15-year and 30-year mortgages only)

- Can only be used for a primary residence

- Qualifying process can require an elaborate home inspection and mandatory repairs

- Limited eligibility (first-time homebuyers and low- to moderate-income borrowers)

- Limited availability (FHA mortgages are only available through FHA-approved lenders)

First-Time Homebuyers Best-Suited for an FHA Loan

The FHA mortgage program was originally designed to help low to moderate income families attain homeownership. Not surprisingly, this popular loan program has become synonymous with “first-time homebuyer loans”.

Prospective first-time homebuyers that have several of the following traits or preferences should strongly consider applying for an FHA loan:

- Low to moderate steady income

- Poor credit score and/or minimal credit history (500 with a 10% down payment)

- High debt-to-income (DTI) ratio (up to 57%)

- Minimal down payment amount on hand (e.g. 10% or lower)

- Preference for a home within the FHA loan limit for your location

- Plan to purchase and live in as your primary residence one of the following types of homes: single-family home; multifamily home with up to four units; condominium; or qualifying manufactured home

3. VA Loans

VA loans are mortgages offered by the U.S. Department of Veterans Affairs (VA). Loans are available to military service members, veterans, and eligible surviving spouses. Designed to help individuals with these military associations to become homeowners, the VA guarantees the loans but the federal agency doesn’t issue or manage the loans.

This aspect of the mortgage process is done through private lenders. People who qualify for VA loans don’t need to worry about down payments or obtaining private mortgage insurance (PMI). They are also often offered favorable loan terms since the loan comes with backing from the VA.

Advantages of VA Loans

- A lifetime benefit to those eligible that can be used multiple times

- No down payment required

- Lower interest rates

- Flexible credit requirements

- Limited closing costs

- Easier to qualify for eligible applicants than most other types of loans

- No mortgage insurance premiums

- Lenders generally limit the maximum VA loan to conforming conventional mortgage loan limits, which are higher than FHA and USDA loans

- No prepayment penalty

- Assistance for struggling borrowers

- Flexibility to finance funding fees

- No minimum credit score requirement

- No predefined loan limit

- Home loan limit is determined by credit-worthiness of applicants

- Streamlined refinancing (Interest Rate Reduction Refinance Loan: IRRRL)

- Loans are assumable

- Surviving spouses may be eligible

- Eligible homeowners can refinance a non-VA loan with a VA mortgage

Disadvantages of VA Loans

- Must provide documented proof of eligibility (COE: Certificate of Eligibility)

- Properties must meet certain safety and livability standards

- Can only be used for a primary residence

- Limited availability (VA mortgages are only available through VA-approved lenders)

- Many VA mortgage lenders require minimum FICO scores of 620 or higher, even though the VA has never established a minimum credit score for a VA mortgage

First-Time Homebuyers Best-Suited for a VA Loan

Any prospective first-time homebuyer (or existing homeowner) who may be eligible for a VA loan, should look at this type of loan as their number one choice of a mortgage or refinancing. The benefits are justifiably vast compared to any other type of mortgage on the market.

An important disclaimer to make is that active members of the military, veterans, and surviving spouses should all do thorough due diligence when considering a VA loan. Given the unique challenges many current and former members of the military may face, it is imperative to get a good understanding of loan qualifying criteria, how to best rectify any previous or current financial setbacks, and the details of how the loan program works.

Unfortunately, persons eligible for VA loans or existing borrowers can be targeted by disreputable businesses and even criminals. According to the Consumer Financial Protection Bureau, complaints have ranged from receiving misleading solicitations, misunderstanding loan details, and receiving fraudulent phone calls that use scare tactics to persuade refinancing.

We strongly recommend seeking multiple referrals to mortgage lenders that have strong reputations and lengthy experience working with VA loans, so you can safely position yourself for this invaluable program.

4. USDA Loans

Many prospective homebuyers are unaware of that the U.S. Department of Agriculture offers a homebuyers assistance program. Eligibility depends upon if the property being purchased is located in a designated rural zone.

This doesn’t necessarily mean the house has to be a farm. Many suburban homes located just outside of major cities meet the criteria for USDA loans. Homebuyers should check with the rules associated with their area to see if corresponding homes qualify. The USDA has two types of mortgage loans, the Section 502 Direct Loan Program, also called a “USDA Direct Loan,” and a Guaranteed Loan. Which of the two loans a borrower is eligible for will depend upon their income level.

- Advantages of USDA Loans

- Disadvantages of USDA Loans

- First-Time Homebuyers Best-Suited for a USDA Loan

Advantages of USDA Loans

- No down payment required for low and moderate income applicants

- No minimum credit score to qualify

- Low interest rates

- No mortgage insurance premiums

- Flexible credit requirements

- No prepayment penalty

- Subsidized closing costs

Disadvantages of USDA Loans

- Only properties located within qualified rural areas are eligible for a USDA mortgage

- Income limits (borrowers cannot exceed 115% of median household income)

- Low borrowing limits ($377,600 for locations not in high-cost areas)

- Properties must meet certain safety and livability standards

- Loan processing may take longer to process than other types of mortgages

- Limited availability (USDA mortgages are only available through USDA-approved lenders)

- Limited funding (there may be a limited amount of USDA loan funds available within a particular area)

- Limited loan terms (33-year for Direct Loan; 38-year for low income borrowers; 30-year fixed rate for Guaranteed Loan)

First-Time Homebuyers Best-Suited for a USDA Loan

Prospective first-time homebuyers that have several of the following traits or preferences should strongly consider applying for a USDA loan:

- Plan to purchase and live in as your primary residence in a qualifying property within an eligible rural area

- Preference for a home within the USDA loan limit for your location

- Low to moderate steady income

- Poor credit score and/or minimal credit history

- High debt-to-income (DTI) ratio (may exceed 41%)

- Minimal down payment amount on hand (e.g. 10% or lower)

- Needs assistance with covering closing costs

Additional Tips for First-Time Homebuyers

Other Potential Mortgage Avenues

First time home buyers can also explore other home assistance options. For instance, they can explore programs offered specifically by their state of residence or home renovation loans (this entails purchasing a home and then remodeling it within the same loan).

Other assistance programs available to first-time homebuyers include:

- ReadyBuyer: 3% assistance toward closing costs on the purchase of a foreclosed property owned by Fannie Mae

- Individual Retirement Accounts (IRAs): waiver of the 10% early withdrawal penalty on up to $10,000 per person if used towards a home purchase

- Down Payment Assistance Programs

To get the best mortgage terms, individuals can take a few proactive steps before they start the house-hunting process.

- Check your credit score and, if it’s too low, look for ways to boost it.

- Decide how much “house” is affordable, so time is spent only looking at realistic home options.

- Start saving money for a down payment sooner rather than later.

- Put aside money for moving costs and potential closing fees (the latter can sometimes be negotiated with the seller).

Homebuyers can also talk to a professional real estate agent who can help guide them through the mortgage process as they begin the search for their first home. Connecting with an expert can also ensure no steps are missed in what can be a confusing and complex process.

Buying a home is an exciting time, but it’s also important to be realistic about the financing aspect. Knowing options ahead of time helps make the process go smoother and will enable finding a first home that is an ideal fit.

Also see:

More Recommended Home Buying Articles

- Secrets to Finding an Undervalued Home for Sale

- 7 New Innovations in New Home Building

- Want the Best Mortgage Deal? Study APRs vs. Interest Rates!

- Proptech That Enables Homebuyers to Make All Cash Offers

- Green Mortgages: An Eco-Friendly Way to Combat Rising Interest Rates

- Want a Nontraditional House? Here’s How to Finance It!

- Real Estate Love Letters: Are They Legal?

- Options for Millennials Determined to Own a Home

- Enjoy Working Remotely? Here’s How to Choose to Live Wherever You Want

- Never Thought You’d Own Land? Think Again!

- Related Topics: Mortgages | Home Buying | Real Estate | Proptech

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |