Updated: October 21, 2021

If you are needing to quickly tap into the equity of your home without taking on more debt, Shared Equity Contracts may be the answer. Here is a compiled list of frequently asked questions.

Table of Contents

- What are Shared Home Equity Contracts?

- Who offers Shared Home Equity Contracts?

- How are Shared Home Equity Contracts different from Home Equity Loans?

- What are the pros and cons of a Shared Home Equity Contract?

- What happens if my property decreases in value after I enter into a Shared Home Equity Contract?

- Can you enter into a Home Equity Agreement if you don’t have a home?

- More Information on Shared Equity Contracts

What are Shared Home Equity Contracts?

Shared Home Equity Contracts, also referred to as Home Equity Agreements, are equity-based financial instruments that enable homeowners to tap into the equity of their homes by allowing an investor to share in the home’s ownership. The homeowner receives an interest-free, lump sum of cash that does not require any monthly payments. The investor, in turn, receives a percentage of the home’s ownership. The homeowner is obligated to pay the investor at a defined time in the future, say 10 or 30 years, for example, or earlier, if the home is sold prior to this date. The payment to the investor is in a lump sum, which includes the original loan amount, plus a percentage of the home’s appreciated value.

Who offers Shared Home Equity Contracts?

The following companies are currently the most established financing companies in the US that offer interest-free, lump sum financing through Shared Home Equity Contracts: Homefunds, Hometap, Point, Unison and Unlock.

UPDATE: Noah stopped accepting new applications as of March 22, 2022, and ultimately ceased operations sometime in Q2 of 2022.

How are Shared Home Equity Contracts different from Home Equity Loans?

Home Equity Loans, also referred to as Second Mortgages, are Debt Instruments that appear on your credit report. Borrowers apply for a set amount of funds, and when approved, receive that amount upfront. The funds must be repaid in monthly installments, based on a fixed interest rate, for a period of time, per the terms of the loan.

Shared Home Equity Contracts are NOT debt instruments, therefore they DO NOT appear on your credit report as debt financing. Homeowners receive funds in a lump sum upfront, however there is no interest rate attached to the principal amount. Borrowers must pay the full principal amount plus a percentage of their home’s appreciated value at the end of 10 or 30 years or depending on the terms of the agreement.

What are the pros and cons of a Shared Home Equity Contract?

The primary advantage of a Shared Home Equity Contract is that the homeowner is not immediately saddled with potentially hefty monthly loan payments, as the payment is deferred for many years or until the home is sold.

The primary disadvantage of a Shared Home Equity Contract is that the homeowner may end up paying significantly more for the initial lump sum financing amount when compared to a Home Equity Loan.

What happens if my property decreases in value after I enter into a Shared Home Equity Contract?

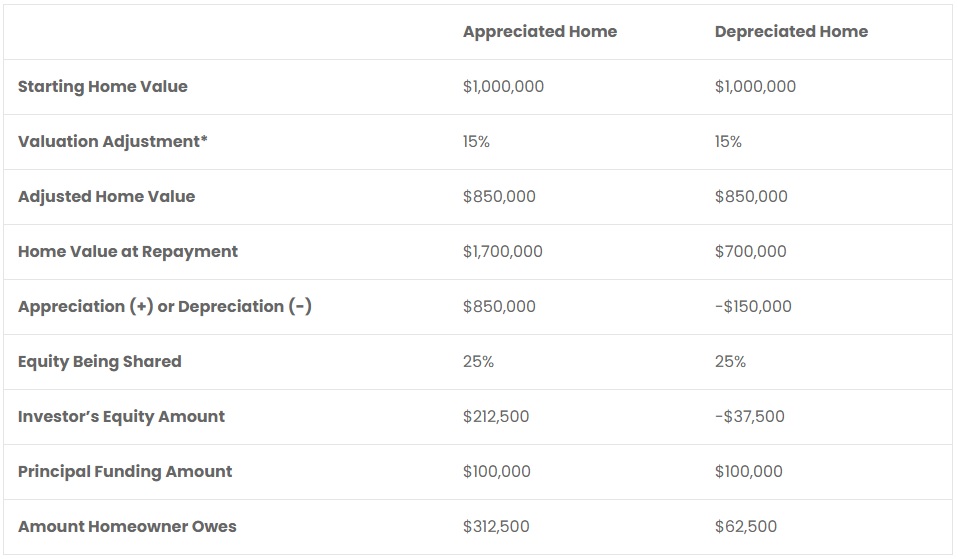

At the end of the term, the homeowner will be required to repay the principal amount plus a percentage of the appreciation value owned by the investor. If the home depreciates in value, the homeowner will deduct the depreciated amount from the principal amount that is owed. Thus the investor will share in the homeowner’s depreciation loss by decreasing the final amount owed by the borrower.

*Most investors adjust the home’s valuation downward by a certain percentage (e.g. 15%) to assuage their risks. This value is then used as the base amount to calculate the amount a home has appreciated or depreciated at the time of repayment (i.e. [Home Value at Time of Repayment] LESS [Adjusted Home Value]).

Can you enter into a Home Equity Agreement if you don’t have a home?

Yes, Home Equity Contracts, also referred to as Home Equity Agreements, can help prospective homeowners get into a home if they are having difficulty raising cash for the down payment. Investors will give a prospective homeowner cash in exchange for a percentage of equity in the property. The homeowner can buy out the investor after some time in the future by exchanging the full principal amount, plus a percentage of the home’s increased appreciation for the investor’s equity interest. Unison’s Homebuyer program is one example of this type of financing option, as well as Haus Mortgage.

More Information on Shared Equity Contracts

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |

You may want to update this article. Unlock now operates not just in California, but also in Colorado, Florida, Michigan, Nevada, New Jersey, North Carolina, Oregon, Virginia, and Washington state.

Will do – thanks for the tip!