This article pertains to the 2019 tax year for taxpayers filing in 2020 and was last updated on March 20, 2020.

This article pertains to the 2019 tax year for taxpayers filing in 2020 and was last updated on March 20, 2020.

Are you aware of the wide range of tax benefits that you may be entitled to as a homeowner or owner of rental property? Even with the Tax Cuts and Jobs Act (TCJA), which went into effect January 1, 2018, and significantly increased standard deduction amounts, there are still plenty of deductions to consider that can help ease your tax liability. We took a comprehensive approach to home ownership deductions that can be taken for the 2019 tax year. This guide consisting of tips and reminders will help your tax preparation for this year, as well as next year’s tax filing.

Federal Tax Day Is Now July 15, 2020

Federal taxes for 2019 are now due on July 15, 2020, which applies to both filing and payments. This is a 90-day extension from the original April 15 deadline. This extension also applies to businesses. The latest update on the extension was announced on March 20, 2020. This is an extension for filing federal taxes, so you need to check your state’s updated tax deadline dates, as they may vary.

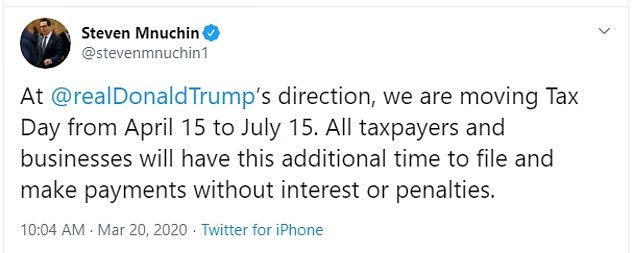

US Treasury Secretary Steve Mnuchin confirmed the extension by tweeting the following on Friday, March 20 at 10:04AM EDT:

At @realDonaldTrump’s direction, we are moving Tax Day from April 15 to July 15. All taxpayers and businesses will have this additional time to file and make payments without interest or penalties.

— Steven Mnuchin (@stevenmnuchin1) March 20, 2020

To help reduce any confusion, please note that the previously announced extension pertained solely to the payment deadline, but had kept the normal April 15 deadline for filing your taxes.

A payment extension means that the IRS will waive all interest and penalties during the 90-day extension period, if you owe any additional taxes. Mnuchin also encouraged all taxpayers who may be receiving tax refunds to file now to get your money, to help both their economic situations and the overall economy.

Normally, an extension only gives you extra time to file your return, but does not give you extra time to pay any taxes due.

Comparing Itemized Deductions to Standard Deductions

Some of the suggestions given in this guide are for homeowners filing with itemized deductions. However these tips can serve as a preliminary check to see if your itemized deductions may surpass the higher standard deduction amounts passed in TCJA. The standard deduction amounts for 2019 tax year are:

- Married Couple Filing Jointly: $24,400

- Head of Household: $18,350

- Individuals or Couples Filing Separately: $12,200

For example, the mortgage interest and property tax deductions are itemized deductions. Historically, a majority of homeowners had enough deductible interest and other qualified itemized deductions greater than the standard deduction amounts. This percentage of itemizing homeowners significantly dropped when dramatically higher standard deduction amounts were introduced for the 2018 tax year.

Who Should Use This Guide

The information we have provided is pertinent to:

- All Homeowners

- New Homeowners

- Homeowners Who Refinanced

- Homeowners Who Sold Their Primary Home

- Homeowners With Rental Income Properties

- Homeowners With Special Circumstances

Homeowner Tax Deductions and Topics Covered in This Guide

The following topics pertaining to homeowners and owners of rental property are included in this guide:

- Mortgage Interest

- Extra Mortgage Payment

- Mortgage Tax Credit Deductions

- Interest on Home Equity and Home Improvement Loans

- Points Paid on a New or Refinanced Loan

- Mortgage Insurance Premiums

- State, Local and Property Taxes

- Home Offices

- Home Improvement

- Energy Efficiency (Solar Electric & Solar Heating)

- Medical/Aging-In-Place

- Maintenance Repairs on Rental Properties

- Improvements on Rental Properties

- Improvements for the Sale of Your Home

- Special Circumstances

- The “Augusta” Rental Income Exemption

- Mortgage Prepayment Penalty

- SBA Disaster Home Loans

- Minister’s or Military Housing Allowance

- Homeowner Costs That Are Not Tax-Deductible

Home Mortgage Interest Deduction

In most cases, you can deduct all of your home mortgage interest. How much you can deduct depends on the date of the mortgage, the amount of the mortgage, and how you use the mortgage proceeds.

Mortgage interest is often the biggest itemized deduction for those without serious medical conditions. Tax reform that passed in recent years preserved the itemized deduction for home mortgage interest, but set a lower limit for new loans of up to $750,000. Not all homeowners will still benefit from this tax break since the standard deduction nearly doubled starting for the 2018 tax year.

The previous $1 million limit was grandfathered for existing mortgages. Here are the cut-off dates, which will run until the year 2025, when the $1 million limit will return:

- For mortgages that went into effect after 15, 2017, homeowners can only deduct interest on the first $750,000 ($375,000 if you are married filing separately) of your loan(s).

- For mortgages that went into effect before 16, 2017, one can deduct interest on loans up to $1 million, ($500,000 if you are married filing separately)

There are no differences between filing separately or jointly. However, married couples filing separately will see the overall amount cut in half.

If your mortgage balance is greater than your cap, here is how you can calculate the amount of mortgage interest that you are permitted to deduct:

- Example Mortgage Interest Scenario:

- Average Mortgage Balance For The Given Tax Year = $1,250,000

- Average Balance = (First Month Balance + Last Month Balance) / 2

- Date Loan Taken: after December 15, 2017

- Maximum Loan Limit: $750,000

- Total Interest Paid In The Given Tax Year: $50,000

- Average Mortgage Balance For The Given Tax Year = $1,250,000

- Divide Maximum Loan Limit by Your Average Mortgage Balance:

- $750,000 / $1,250,000 = 0.6 or 60%

- Multiply Your Total Interest Paid by the Percentage Result:

- $50,000 X 60% = $30,000

- $30,000 is the amount of mortgage interest you would be allowed to deduct in this scenario

Additional Home Mortgage Interest That Can Be Deducted

The IRS looks at mortgage interest deductions carefully, but a single extra end-of-year payment normally is allowed.

If your loan amount is under the applicable cap, there is an additional way to increase your total deductible interest amount. If you made an extra mortgage payment in the month of December of the given tax year, 2019 (i.e. your January 2020 payment), you can add this interest payment to your total interest deduction for your 2019 taxes. If you did not make this additional payment in December 2019, be sure to schedule a payment this year 2020 in December. Just make sure the payment is received before January of the following year, 2021.

Mortgage Tax Credit Deduction

The Mortgage Credit Certificate (MCC) is designed for low-income homebuyers who are making a purchase for the first time. It provides a 20% mortgage interest credit of up to 20% of interest payments. The size of the credit does depend on the area of the country in which you live. The cap on this tax credit is $2,000 per year if the certificate credit rate exceeds 20%.

This credit is available every year that you have the loan, and for every year that you live in the house you purchased with the certificate. Any credit will be automatically subtracted from the income tax you owe. To claim this credit, you must apply to your local or state government to obtain the certificate.

Interest on Home Equity Loans and Home Improvement Loans Deduction

Before 2018, the interest on home equity loans up to $100,000 could be fully deducted. The money from the loan could be used for anything you wanted, and you’d still get to take advantage of the deduction. For example, a homeowner could deduct interest from a home equity loan and then use it to pay for a college education or to pay down credit card debt. As a result of the TCJA, that deduction has been removed from 2018 through the tax year 2025.

However, one piece of good news is that the deduction is still available if you use the money to buy, build, or improve your main or a second home. This loan must also be secured by your primary or secondary home. For example, you can take the deduction if you wish to add another room to your home or remodel your kitchen.

Take note that this deduction counts towards the interest deduction limit on mortgages listed in the first part of this guide. So if your first mortgage is over the deductible limit, then the home equity loan interest will not be deductible. However, if under the cap, you can add the amount of the home equity loan to your existing mortgage loan amount, up until the combined amount is at the mortgage loan cap.

Similarly if you have a Home Improvement Loan, that is secured by your main home or second home, you can deduct all of the interest within your total loan cap. This, of course, is with the understanding that 100% of the proceeds from the loan are going towards home improvement activities for your primary or secondary homes.

The Mortgage Points Deduction

The ‘Points’ system is a fee charged by mortgage lenders. One discount point costs 1% of the mortgage amount. Most home loans have between one and three points, which can lead to thousands of extra dollars you must pay upfront and out of pocket.

If you are within the limit to deduct all your mortgage interest, you may also be able to deduct discount points you paid when the mortgage closed. Some homeowners buy discount points to lower their mortgage interest rate.

The term “points” can be confusing because some lenders call their fees “loan origination points.” Those points go toward paying the lenders’ costs for providing the loan, and they are not tax-deductible. Only discount points paid to reduce the interest rate can be deducted.

If you started a new mortgage, refinanced an existing mortgage or received a home improvement loan in the given tax year, you can fully deduct the value of the points from your tax, if you meet certain criteria. The nominal criteria when you can deduct the full amount are: this is for your main home; paying points is an established business practice and were not more than generally charged in your area; you use a cash method of accounting (use date of income received and payments made); you fully paid for the points without outside assistance; and the amount is only for a “discount point” fee and does not include other miscellaneous fees.

If for some reason you do not meet this criteria, you can still deduct the discount point fees ratably over the life of the loan.

For more details see the IRS Guidance on Points and Deductions.

Mortgage Insurance Premium Deduction

You may be able to take an itemized deduction for premiums you pay or accrue during 2019 for qualified mortgage insurance in connection with home acquisition debt on your qualified home.

Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration, the Federal Housing Administration, or the Rural Housing Administration, and private mortgage insurance (as defined in section 2 of the Homeowners Protection Act of 1998, in effect on December 20, 2006).

Mortgage insurance premiums you paid or accrued on any mortgage insurance contract issued before January 1, 2007, are not deductible as an itemized deduction. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums.

The amount of mortgage insurance premiums you paid during 2019 may be shown in box 5 of Form 1098.

For more details see the section on Mortgage Insurance Premiums in IRS Pub. 936.

State and Local Tax (SALT) Deductions, Including Property Taxes

One of the most significant introductions with the TCJA was an annual cap on how much you can deduct from property, state, and local taxes. Previously, you could deduct the full amount of town and state taxes associated with things like income taxes, property taxes, and sales taxes. This has changed.

The TCJA tax reform caps your state and local deduction at $10,000 or $5,000, if married filing separately. You still have to be able to itemize in order to get this benefit. In states where tax liability is higher, such as California, New York and Massachusetts, this is untenable. As residents of those states suffer big tax burdens at the local level. This cap lasts from the 2018 through the 2025 tax years.

Regarding Property Tax deductions, unfortunately, there is no index for inflation, and both single and married taxpayers have the same limit. If your lender demanded that you set up some form of escrow or impound account, you cannot deduct the money held for property taxes until the money is used to pay them. Any city or state refund on property tax is deducted from the possible Federal reduction.

For more details see:

- IRS Topic No. 503 Deductible Taxes

- IRS Guidance on Tax Treatment of State and Local Tax Refunds

- IRS Final Regulations on Charitable Contributions

Tax Deductions for Home Offices

Are you using part of your home to run a business on an exclusive basis? If so, you may be able to deduct a portion of your household costs, such as: utilities; homeowners insurance; property taxes; and mortgage interest. You can also depreciate the business portion for tax purposes, as well. However, you are not allowed to deduct expenses from services that happen outside of the home, such as lawn care services.

You will need to separate out the costs associated with using your home for your business and normal personal purposes. To claim the deduction, an area of your home must be designated as your principal place of business, and used exclusively for work. Everything in that designated space needs to be for work purposes only.

Next, you need to accurately measure your work area as a percentage of your home’s livable space. Then this percentage of your household expenses can be allocated to your home office deduction. This includes home improvement costs, if the work space also benefited from the upgrade, such as a new HVAC system. So if your office space breaks down to 10% of your home’s total square footage, you can deduct 10% of your home costs.

A more simplified way to estimate your home office deduction was enacted in 2013. It allows homeowners to deduct $5 per square foot of home office space. However, the entire deduction has a limit of $1,500.

For more information see the IRS’ guidance on Home Office Deduction.

Tax Deductions for Home Improvements

Energy Efficiency Upgrade Deductions

The Residential Energy Efficient Property Credit was a tax incentive for installing alternative energy upgrades in a home. Most of these tax credits expired after December 2016. However, two credits are still active. The credits for solar electric and solar water heating equipment will remain active through December 31, 2021.

The Secure Act also retroactively reinstated a $500 deduction for certain qualified energy-efficient upgrades, such as exterior windows, doors, and insulation. This is a credit so it is unrelated to itemized deductions.

However, the percentage of the credit varies based on the date of installation. For equipment installed between Jan. 1, 2017, and Dec. 31, 2019, 30% of the expenditures is eligible for the credit. That goes down to 26% for installation between Jan. 1 and Dec. 31, 2020, and then to 22% for installation between Jan. 1 and Dec. 31, 2021.

For more details see IRS’ Energy Incentives for Individuals.

Medically Necessary Home Improvement Deductions

When figuring out your medical expense deductions, you can include the cost of installing health care equipment or other medically necessary home improvements that benefit you, your spouse or a dependent. However, permanent improvements that increase your home’s value are only partially deductible. The deductible cost is reduced by the amount that the property increased in value.

Popular improvements to make a home more accessible, such as entrance ramps, the widening of doorways and installing railings and support bars, usually do not increase the value of a home and can be fully deducted. You will also need a letter from a doctor to support that these changes were medically necessary.

These home improvement costs must also exceed 7.5% of your adjusted gross income (AGI). If your AGI was $100,000, for example, this deduction would be for costs incurred over $7,500. Because of the AGI threshold on deducting home improvements as a medical expense, it is advisable to group as many of these upgrade expenses together into a single year. This will give you the largest deduction possible for that year.

We recommend seeking professional tax advice if you proactively made improvements to your home for Aging-In-Place reasons. Though many necessary medical improvements may be the same as Aging-In-Place best practices, it is our interpretation that allowed deductions are solely for changes that were medically necessary now and not at a future date. There has been political activity around a federal Aging-In-Place tax credit bill that would address these issues, but as of yet, it has not been signed into law.

For more details see:

Rental Property Deductions

Though rental income is taxable, that does not mean that everything you collect from tenants is taxed. Property owners are allowed to reduce rental income by subtracting expenses incurred during a given tax year. These costs pertain to prepping a property to be rented, upgrades and on-going maintenance expenses.

If you receive a deposit for first and last month’s rent, it is taxed as rental income in the year it is received. Deposits for the last month’s rent are taxable when you receive them, as they are payments made in advance. Security deposits are not included as income when you receive them if you plan to return them to your tenants at the end of the lease.

Rental expenses that can be deducted from rental income include: advertising; cleaning and maintenance; commissions; depreciation; HOA and condo fees; insurance premiums; interest expense; local property taxes; management fees; pest control; professional fees; rental of equipment; repairs; supplies; trash removal fees; travel expenses; utilities; and yard maintenance.

The cost of property improvements, however, generally must be capitalized and depreciated over several years, following IRS depreciation tables, rather than deducting fully in the year paid. Conversely, the cost of common maintenance repairs can be deducted fully in the year that they were paid.

Rental income and expenses are reported on Schedule E, Supplemental Income and Loss. Schedule E is then filed with Form 1040.

For more information also see the IRS’ Tips on Rental Real Estate Income.

Tax Deductions When Selling a Home

Selling Costs

These expenses are allowed as long as they are directly tied to the sale of the home, and you lived in the home for at least two out of the five years preceding the sale. The home must be a primary residence and not an investment property. These costs include: home staging costs; legal fees; escrow fees; advertising; and agent commissions. These expenses are then subtracted from the sales price of your home, which will lower the amount of capital gains tax you are obligated to pay.

Home Improvements and Repairs

If you renovated your home to sell quickly or to obtain a higher price, you can deduct those upgrade costs. This includes improvements like painting the house, repairing the roof or installing a new water heater. The key requirement, however, is that these improvements need to occur within 90 days of the closing.

Capital Gains Tax for Sellers

Capital gains are your profits from selling your home, the profit remaining after paying off expenses and any outstanding mortgage debt. These profits are taxed as income. However, you can exclude up to $250,000 of the capital gains from the sale if you are single, and $500,000 if married. To receive this exclusion you must meet the following criteria:

- The home must be your primary residence

- You must have owned it for at least two years

- You must have lived in it for at least two of the past five years

- You cannot have taken this exclusion in the past two years

If you sell your home in one year or less, this is classified as a short-term capital gain. If you sell your home after you having it for more than one year, this is considered a long-term capital gain. Long-term capital gains are subject to lower capital gains tax rates than short-term gains.

Short-term capital gains tax rates range from 10% to 37% based on your income level. Long-term capital gains tax rates are lumped into three tiers – 0%, 15%, and 20% – depending upon your income level.

What if you have a loss from selling real estate? If you sell your personal residence for less money than you paid for it, you cannot take a deduction for this capital loss. It is considered to be a personal loss, and a capital loss from the sale of your residence does not reduce your income subject to tax.

If you sell other real estate at a loss, however, you can take a tax loss on your income tax return. The amount of loss you can use to offset other taxable income in one year may be limited.

Donated Small Items and Other Home Goods

An intensive spring and fall cleaning of your home is a great way to rid yourself of lightly used, still in good condition items. These items when given to a thrift or second-hand store represent a “donation” and are thus deductible. Always get a receipt from the receiving organization and make sure the dollar value is spelled out with the correct date of the donation. Should you choose to donate larger, more expensive items, whose value exceeds $5000, make sure to have the item professionally appraised and keep this appraisal for your records.

Special Circumstance Tax Deductions

The “Augusta” Rental Income Exemption

The “Augusta Exemption” is the popular name for Internal Revenue Code Section 280A(g), nicknamed after the prestigious Masters professional golf tournament held annually at the Augusta National Golf Club in Augusta, Georgia. The exemption was originally created for nearby homeowners of the golf course, so that they would have incentive to rent their homes to a large annual crowd of international visitors to the tournament. This exemption survived TCJA and provides a homeowner with a short period of tax-free rental income per year.

Section 280A(g) states: “if a dwelling unit is used during the taxable year by the taxpayer as a residence and such dwelling unit is actually rented for less than 15 days during the taxable year, then … the income derived from such use for the taxable year shall not be included in the gross income”.

Another way to allocate this 14-day taxable income reprieve creatively, is across seven weekends during peak tourist periods throughout the year.

Mortgage Prepayment Penalty

If you pay off your home mortgage early, you may have to pay a penalty. You can deduct that penalty as home mortgage interest, provided the penalty is not for a specific service performed or cost incurred in connection with your mortgage loan.

SBA Disaster Home Loans

Interest paid on disaster home loans from the Small Business Administration (SBA) is deductible as mortgage interest, if the requirements discussed earlier under Home Mortgage Interest are met.

Minister’s or Military Housing Allowance

If you are a minister or a member of the uniformed services and receive a housing allowance that is not taxable, you still can deduct your real estate taxes and your home mortgage interest. You do not have to reduce your deductions by your nontaxable allowance. For more information, see Pub. 517, Social Security and Other Information for Members of the Clergy and Religious Workers, and Pub. 3, Armed Forces’ Tax Guide.

Moving Costs for Active Members of the Military

Moving cost deductions are now limited to military service members only, per changes enacted by TCJA in 2018. In order to be eligible for these deductions, active duty personnel must be required to move due to a permanent change of station. Moving costs deductions can include items such as transportation expenses, lodging and storage fees.

What Is New This Year from the IRS

The following tax benefits were set to expire but have been extended:

- The itemized deduction for mortgage insurance premiums has been extended through 2020

- The credit for non-business energy property has been extended through 2020

- The exclusion from income of discharges of qualified principal residence indebtedness has been extended through 2020

Homeowner Costs That Are Not Tax-Deductible

TCJA eliminated the deduction for theft and personal casualty losses, although taxpayers can still claim a deduction for certain casualty losses occurring in federally declared disaster areas. Here is a list of common costs associated with homeownership that the IRS explicitly states are NOT allowed to be taken as deductions. However, some cost items, like utilities, are allowed to be partially included, if you are filing a home office deduction.

- Home Insurance Premiums

- Fire Insurance Premiums

- Title Insurance Premiums

- Mortgage Payments to Reduce Principal

- Homeowner Association fees

- Transfer taxes or stamp taxes

- Utilities costs, such as gas, electricity or water

- Rent for living in the home before closing

- Costs for getting or refinancing a mortgage, such as loan assumption, credit report and appraisal fees

- Depreciation

- Forfeited deposits, down payments or earnest money

- Wages for domestic help

- Foreign taxes paid on real estate

Related Articles

New State Laws that Affect Homeowners in 2020

New California Laws That Affect Homeowners in 2020

New Texas Laws that Affect Homeowners in 2020

3RD Party Resources

Pub. 530 (2019), Tax Information for Homeowners

About Pub. 530, Tax Information for Homeowners

Pub. 523 (2018), Selling Your Home

Pub. 527 (2019), Residential Rental Property

IRS Homeowner Related Publications

- 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments

- 523 Selling Your Home

- 525 Taxable and Nontaxable Income

- 527 Residential Rental Property

- 547 Casualties, Disasters, and Thefts

- 551 Basis of Assets

- 555 Community Property

- 587 Business Use of Your Home

- 936 Home Mortgage Interest Deduction

IRS Homeowner Related Forms

- Schedule A (Form 1040 or 1040-SR) Itemized Deductions

- 5405 Repayment of the First-Time Homebuyer Credit

- 5695 Residential Energy Credits

- 8396 Mortgage Interest Credit

- 982 Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment)

Have you visited the new Purgula News page? It covers all things related to homeownership, home improvement, interior design, real estate, and more – updated daily!