A recent commercial by a company claiming that home title theft is 2.5 times more rampant than credit card theft ran continuously for over a month in Southern California. The company claimed that a deed to your property could be stolen so easily, that you may not even know that the theft has already occurred. The ad further “explained” that you may not become aware until you are evicted due to a foreclosure or the “new owners” show up to move into their newly purchased property.

Is home title theft a real threat? Is this crime rampant and more prevalent than credit card theft? Before signing up for a Home Title monitoring service, here’s what you need to understand to assess the risk to your home and financial well-being.

Table of Contents

- What is the Difference between Home Title Theft and Home Title Fraud?

- What is Home Title Theft?

- How Does Home Title Theft Occur?

- How Prevalent is Home Title Theft?

- How Can You Prevent Home Title Theft?

- What to Ask If Considering a Home Title Monitoring Service

- Who is Most at Risk of Being a Victim of a Home Title Scam?

- Home Title Crime Facts & Statistics

- Frequently Asked Home Title Crime Questions

- Home Title Crime Resources

Also see:

- Real Estate Love Letters: Are They Legal?

- Why You Should Never Lend Your Ladder to Your Contractor

- What You Should Know When an Agent Represents Both Buyer & Seller

- Important Must-Have Legal Documents for Homeowners

- More Homeownership & the Law Articles

- Related Topics: Home Buying | Home Selling | Home Inspections | Legal Matters | Financing

What is the Difference between Home Title Theft and Home Title Fraud?

There are two common scenarios that fall under the umbrella of Home Title Crime that warrant clarification:

- Home Title Theft

- A crime that tricks a legitimate homeowner into signing their title deed over to a criminal (AKA Real Home Title Theft)

- A crime that involves creating a fake deed of trust that may also involve a form of identity theft (AKA Fake Home Title Theft)

- Home Title Fraud

- A crime that primarily impacts a homebuyer who is tricked into a purchasing a property that is not the seller’s legitimate property to sell

- This crime typically involves an unoccupied property with an actor falsely portraying the legitimate property owner

What is Home Title Theft?

Home Title Theft occurs when a home’s deed or title is transferred to another owner, without the knowledge of the legitimate owner. This crime is also known as property or deed fraud. This form of “home stealing” allows criminals to then take out loans, using the home as collateral, with the legitimate homeowner left with the financial burden and loss all of their equity accumulated over the years.

In home title theft cases, the owner is usually unaware that the theft has occurred or that the property has transferred title, as the process is performed surreptitiously with no warning to the homeowner or verification from third-party sources, such as title companies or banks. The unknowing homeowner will have been duped into signing a document, which transferred ownership of the property to a third party.

By the time the legitimate homeowner is made aware of the title theft, the home no longer has their name on the deed, and there is a lien placed on the property due to the loans taken out against the property by the fraudsters.

How does Home Title Theft Occur?

Home Title Theft typically involves a criminal that deceives a legitimate homeowner into unwittingly signing a quitclaim deed that transfers the title of the property to the criminal. The homeowner is under the false impression that this “transaction/document” is in lieu of a home equity loan. We refer to this type of theft as “Real Home Title Theft”, as unfortunately, the criminal obtains a legal document that proves transfer of ownership.

Recent radio and television commercials have alerted homeowners to another type of “home title theft”, which occurs without their knowledge or involvement. We refer to this type of theft as “Fake Home Title Theft”, as legitimate homeowners are protected from fraudulent documents, forged signatures and claims, under the normal rule of law.

In the theft discussed in the ads, the legitimate property owner would not be liable for damages if for example, a bank gave home equity funds to an unauthorized property owner. Furthermore, the lender could not then foreclose on the property derived from a fraudulent loan application made by a third-party criminal.

Commercials that feature former House Speaker, Newt Gingrich along with some former FBI Special Agents on Cybercrime detail how the most common unsuspecting way the crime can occur without your signature, Social Security Number or involvement:

- Thieves search the Internet for a property using publicly available information

- A Quitclaim deed is created online using either the thief’s name or another third-party or “straw buyer”, who is somehow involved in the crime

- The Quitclaim deed is filed with the county and recorded as a “sale” listing the new owner of the property

- The thieves then borrow against the equity on the property or the property is sold to an unsuspecting third-party and the thieves pocket the cash from the sale

- Actual homeowners receive foreclosure notices after 90 days, due to the change in status and the non-payment of mortgage on the property to the “new” lender

- Actual homeowners are surprised by a knock on the door of persons claiming to be the new homeowners, as they too were duped into purchasing a property that was sold to them fraudulently

How Prevalent is Home Title Theft?

Although the ease at which a home’s title can be fraudulently transferred seems ominous and terrifying, the truth is, home title theft is actually quite rare in today’s market.

Home title fraud, on the other hand, was common in 2008 and involves selling a fraudulent title to an unsuspecting homebuyer.

During the home mortgage crisis of 2008, home title fraud was prevalent, as many homes were vacant and this made it easier for thieves to perpetrate their crimes. The fraudster created documents which had his name on the deed of the home he was attempting to sell, and “transacted” a sale, usually to an all cash buyer. The buyer later learned that they were not the true owner of the property, as the “seller’s” documents were forgeries.

The Lessons from 2008 Home Title Fraud

During this period, the number of foreclosure cases was well over 520,000 in California alone, which overwhelmed the banks and various agencies, leaving homes sitting idle and ripe for crime.

The total US foreclosures in 2008 affected well over 6 million households, so you can imagine how unprepared financial institutions were to process these properties, leaving them unattended for months, even years. These unique conditions were crying out for devious fraudsters to profit from the inefficiencies of voluminous foreclosure activity.

Today, according to Allstate Identity Protection, deed or title theft is rare, with the targets being mainly vacation homes or rental properties. However, if you are struggling to pay your mortgage, you can become prey to fraudsters looking to “assist” you with paying your mortgage by offering refinancing opportunities that never materialize.

By the time you have signed their documents and are awaiting your check, you soon realize that you have been bilked out of your home by signing over the property’s title. The fraudsters are long gone, as they have already taken out a mortgage loan on the property that you have unsuspectingly “sold”.

The bank who loaned them the funds loses money to the fraudulent buyers, but you also lose, since during the process you have unwittingly transferred title to a criminal third-party.

Unfortunately, in this type of situation, the homeowner legitimately signed title to another party, meaning the homeowner has little to no recourse. However, if transference of title occurs without your permission or involvement, rest assured the home is still legitimately yours, as fraudulent paperwork voids the sale.

However, the cost to hire an attorney to clear the title and your rights as the legitimate homeowner is a financial obligation that you still must bear.

How Can You Prevent Home Title Theft?

Even if title theft is not as prevalent as some advertisements attest, there are still a few measures that you can take to prevent title theft from happening to you.

Never transfer title of your home to a third-party who offers to assist in helping you with a dire financial situation. Always make mortgage payments to your mortgage lender ONLY. Do not engage “mortgage rescue” companies, regardless of how legitimate they appear to be.

Although it is true that your name can be forged on legal documents in an attempt to transfer title of your home, this would only be an “attempt”. Since the documents would be forged, the title would not be conveyed to the “new owner” in such a transaction.

Only the legal property owner can legitimately transfer a title to a third-party. If a bank or other financial institution lends money to a fraudster using your property as collateral, based on forged documents, the lender is the one who loses. You will still be the legal owner of the property and are not liable for repaying any monies that were loaned to a third party.

If you receive any unsolicited, unknown mail to your address, especially from a bank, mortgage lender or the county recorder, do not toss it! Every time you buy, sell, or take a loan on your property, the recorder’s office sends you a copy of the recorded document. This gives you a chance to review the document to be sure that it is correct. The copy is sent to the property address and any other address on file at the County Assessor’s Office.

If someone has taken a loan out on your property without your knowledge, you will need to follow up with the sender to rectify the situation.

Banks and other financial institutions will also send the documents to the property listed on the deed, so open it and follow up with the sender to understand why this information is being sent to your address.

Successful title theft is often the result of identification theft, so, making sure to put a security “freeze” on your financial information will give you peace of mind that allows you to control your finances and other assets.

Experian offers a free Credit Freeze option that limits access to your Experian credit report, which protects you against identity theft. Only you can control who can and cannot see your financial information, with the ability for you to “Thaw” your account if you have a legitimate need.

Invest in a quality paper shredder and shred any mail or documents with any of your identifiable information.

Companies who offer to sell you a Home Title Monitoring service to prevent against home title theft are not being truthful about the prevalence of the crime or the supposed ease of stealing a home’s title.

Any mortgage banker will verify that the only sure way to lose your property’s deed is to knowingly or unknowingly sign a document transferring that deed to a third-party.

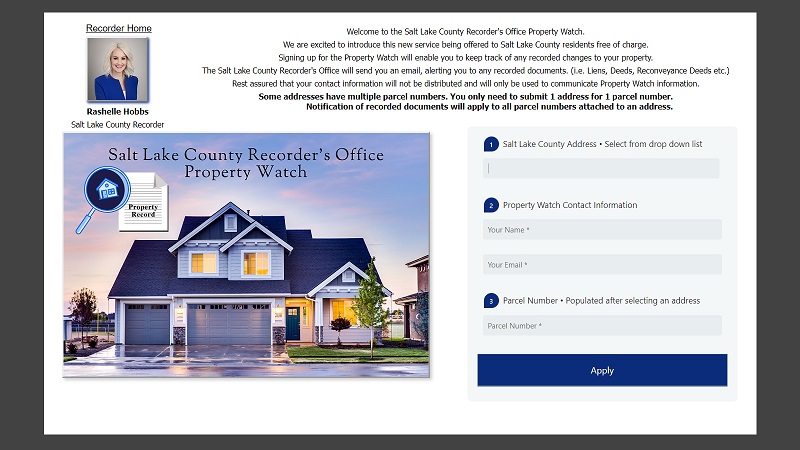

Check if your County Recorder’s Office has a Property Watch monitoring service, which will alert you to any changes in your property’s title for free.

What to Ask If Considering a Home Title Monitoring Service

If you are considering paying a third-party to provide protection against home title theft (AKA Home Title monitoring service), be sure to get in writing the tangible benefits that the company will provide. At a minimum, they should provide insurance to cover the legal costs to clear any title defects, including hiring an attorney.

We are wary of the term “locking a title”, as there is no such thing.

We also recommend reading legal opinions and investigative news reports on the value of various home title locking or monitoring services:

- Is Home Title Lock “Insurance” a Waste of Money?

- Title Theft is Not the Problem, Despite Ad Claims

- Title Lock Insurance is a Waste of Your Money – FOX 5 Atlanta

- Ads Claim Title Thieves Can Steal Your Home, But Can You Really Lose Your House?

Investigative Report on Home Title Monitoring Services by KSL5 Salt Lake City News

Who is Most at Risk of Being a Victim of a Home Title Scam?

- Elderly Homeowners with Equity in their Homes and No Mortgages

- Owners of Second Homes, Vacation Homes or Investment Properties

- Absentee Landlords

- All Cash Buyers

- Lenders

- Title Insurance Companies

Home Title Crime Facts & Statistics

Unfortunately, there are not any readily available hard statistics that show the exact volume of Home Title-related crimes. Any crimes related to home title fraud or theft are lumped into a larger category of Real Estate/Rental fraud crimes by the FBI, in their annual Internet Crime Report.

Those companies looking to sell home title monitoring services, often cite these statistics:

- In 2017, the FBI reported 9,600 real estate and rental fraud victims, with losses totaling approximately $56 million

- In 2019, just two years later, these two FBI-reported numbers grew to almost 12,000 real estate and rental fraud victims, with losses of approximately $221 million

However, we were unable to find any crime statistics of “real home title theft” where a homeowner knowingly or unknowingly transferred homeownership to a criminal. Keep in mind that this type of “real theft” can also happen between family members, e.g. a grandson stealing the home from his grandparents.

Keep in mind that crimes grouped into the FBI’s category of Real Estate & Rental fraud also include:

- Rental Scams

- Timeshare Marketing Scams

- Loan Modification Scams

- Compromised Business Email Accounts Involving Wire Transfer Payments

The last item listed, compromised business email accounts, have especially targeted the real estate sector in recent years, including title companies, law firms, real estate agents, buyers and sellers. The scam often entails having the email recipient change the payment type and/or payment location to a fraudulent account during a legitimate real estate transaction.

Frequently Asked Home Title Crime Questions

Questions and answers to help provide truth in advertising.

Can thieves simply change ownership of your home without your knowledge or involvement?

Simply? Absolutely not – there are numerous safeguards in place that protect lenders, title companies, and real estate firms from being duped by fake documents and applications. In fact, there is almost a zero chance that an attempt of a fraudulent transfer won’t be discovered.

Can fraudsters use your home’s collateral without your knowledge or involvement, leaving you with payment debt on their loans?

No, the required documentation for a home equity loan, including credit reports, employment verifications, income statements, tax returns, appraisals, and title insurance are highly likely to alert both you and the lender that something is amiss.

Home Title Crime Resources

- Is Home Title Lock “Insurance” a Waste of Money?

- FTC Fraud-Related Crime Trend Reports

- Business E-mail Compromise: The 12 Billion Dollar Scam

- Allstate Identity Protection

- FBI 2008 Archives on House Stealing

- Starting Over: NYU Professor Tracks Post-Foreclosure Outcomes During the Great Recession

- Historical Perspective: Foreclosures Were Up a Record 81% in 2008

Recommended Homeownership & the Law Articles

- Homebuyer Beware: The Perils of Flipped Homes

- Why You Should Never Lend Your Ladder to Your Contractor

- Best Online Legal Services for Homeowners & Property Owners

- Lien Waivers: What Homeowners Need to Know

- How to Live in a World of Fake Reviews

- More Homeownership & the Law Articles

- More Real Estate Articles

Legal Disclaimer: The information provided in this article and on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available in this article and on this site are for general informational purposes only.

| Purgula is reader-supported. When you click on links to other sites from our website, we may earn affiliate commissions, at no cost to you. If you find our content to be helpful, this is an easy way for you to support our mission. Thanks! Learn more. |